Roth 401k: Smart Moves You’re Missing

Roth 401k contributions can be a powerful tool, but only if you know how to use them wisely. In this episode, Matt shares practical tax strategies for deciding when, why, and how to contribute to a Roth 401k through your employer plan.

2 Min Read

Medtronic Benefits Employees Miss Out On

Medtronic offers one of the most generous benefits packages in the industry, but many employees aren’t using those benefits to their full potential. In this episode, Matt highlights three valuable but often overlooked Medtronic benefits beyond the standard 401(k). These include the Employee Stock Purchase Plan (ESPP), Health Savings Accounts (HSAs), and optional long-term disability insurance.

2 Min Read

Can You Build a Tax-Free Retirement Fund with an HSA?

Are Health Savings Accounts one of the best tax-advantaged accounts out there? Can you really stockpile a massive balance and use it tax-free in retirement? Today, Matt and Jacob will explain why HSAs can be one of the most powerful tools for long-term, tax-advantaged growth and why using it wisely takes more than maxing out your contributions.

2 Min Read

Financial Planning for Medtronic Employees and Executives

Do you work at Medtronic? Get the resources you need and expert insights from financial professionals who specialize in helping Medtronic employees make the most of their compensation package and benefits. Whether you’re a new Medtronic employee…

10 Min Read

5 Mistakes You Are Making In Your Medtronic Retirement Savings Plan

If you’re participating in the Medtronic Retirement Savings and Investment Plan, you already understand its value, but are you using it as effectively as possible? Unfortunately, we see some simple mistakes that can easily be avoided. To-day we’ll highlight each of these avoidable missteps to make sure you’re maximizing every dollar you contribute.

2 Min Read

How to KEEP Company Contributions in Your Medtronic 401K Plan

If you participate in the Medtronic 401K plan, you already know about the great company contribution you receive, but will you be able to keep all of that money when you leave? If you’re not paying attention to the fine print, you could leave thousands of dollars on the table. Today, we’re going to break down the vesting rules and timing triggers that determine how much of your company contributions you actually get to keep.

2 Min Read

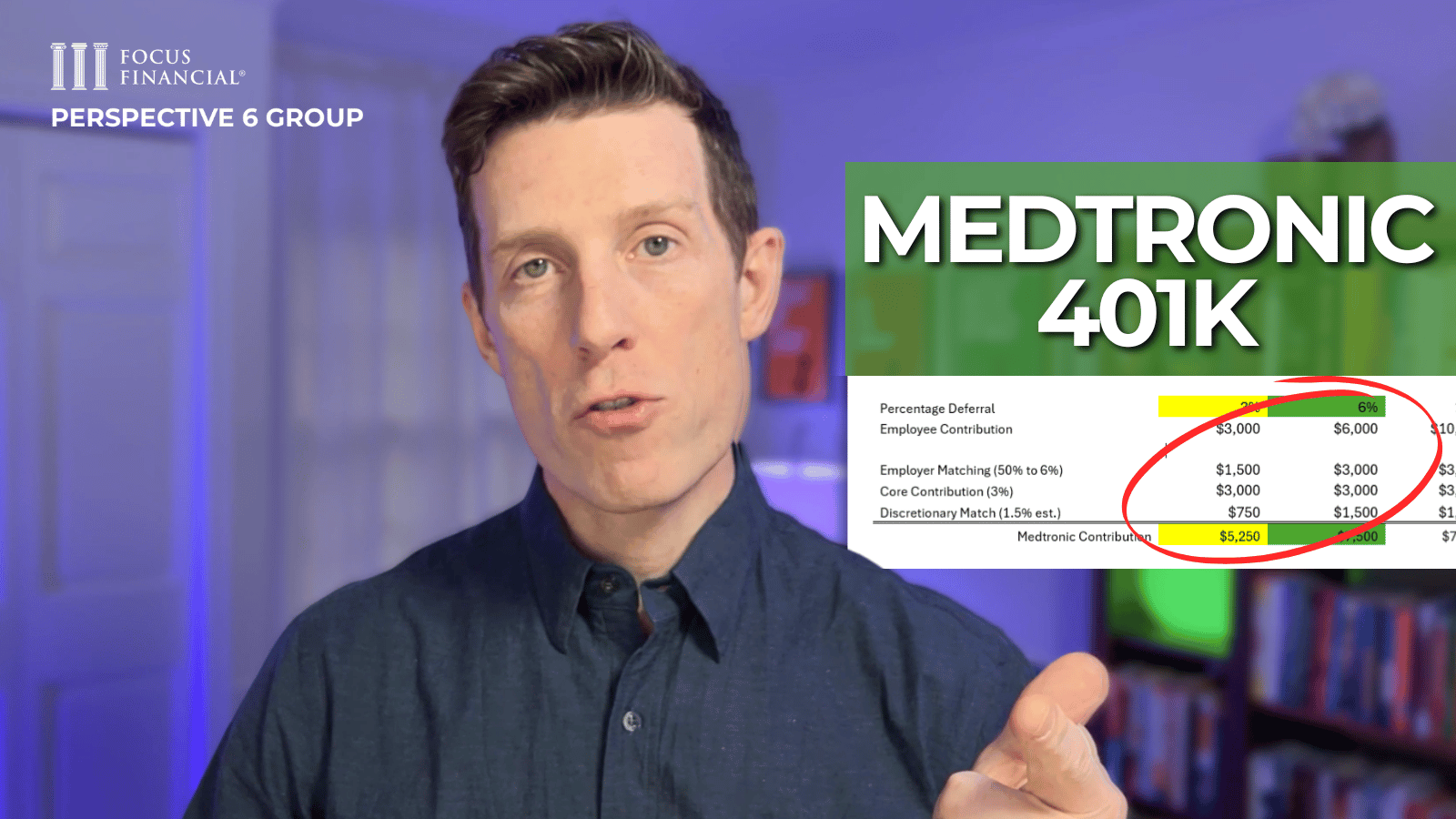

Your Medtronic 401k Plan Company Contributions Explained

Do you know if you are getting all of the contributions available to you in your Medtronic 401k? We’ve been getting a lot of questions about how to optimize the Medtronic 401K plan so we’re going to give you an advisor’s take on how it works and the settings that every employee should be checking.

2 Min Read