2025 Market Outlook: Insights on Navigating Volatility

The year’s final “Santa Rally” hasn’t aligned with past patterns, but this isn’t surprising. Markets don’t adhere to calendars or historical events. While trends and historical data hold value in analysis, the movement of stocks operates independently of dates. Instead, market behaviors revolve around broad trends, probabilities, and informed speculation. Let’s look at the impact this might have and gain a sense of the overall market outlook for 2025.

Technical Analysis vs. Fundamental Realities

Technical data offers a window into large-scale investor activities, such as money flows and market sentiment. It allows us to craft calculated strategies based on probabilities rather than certainties. For instance, oversold market indicators alongside immense selling volume could signal a nearing trend shift.

However, it’s crucial to remember that technical analysis reflects possibilities, not facts. It serves as a tool for informed decision-making, especially when identifying short-term market movements. Technical patterns won’t predict a company’s next earnings report or the precise direction of the Federal Reserve sentiment. The analytics reveal historical data which can help frame risk management strategies for long-term portfolios.

The Investor vs. The Trader

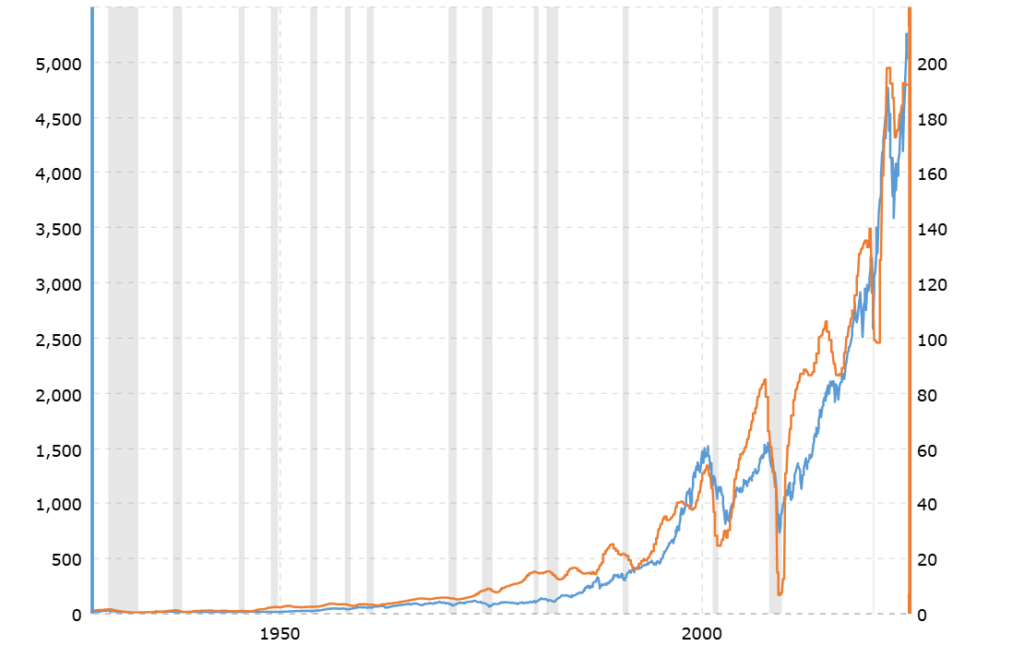

The investor mentality is well-suited to leveraging longer-term technical analysis when considering shifts between equities, bonds, or cash holdings. While trading often follows technical signals, real stock value is connected to earnings growth, specifically. Over time, the S&P 500’s returns closely track earnings growth. Although short-term fluctuations occur, long-term alignment between earnings and index returns is consistent.

For this reason, we focus on indices rather than individual stock picking, skipping in-depth balance sheet analysis and earnings call assessments. For broad economic analysis we utilize unemployment, interest rates, consumer spending, and currency trends. These factors guide us in shaping future investment assumptions.

Ultimately, the balance between technical and fundamental analysis depends on perspective. Fundamentals influence annual market trends, while technical factors dictate daily market movements. A day trader may chase fractional gains on intraday signals, but a long-term investor must understand both the economic environment and a company’s inherent value.

2025 Market Outlook – Fundamental Perspectives

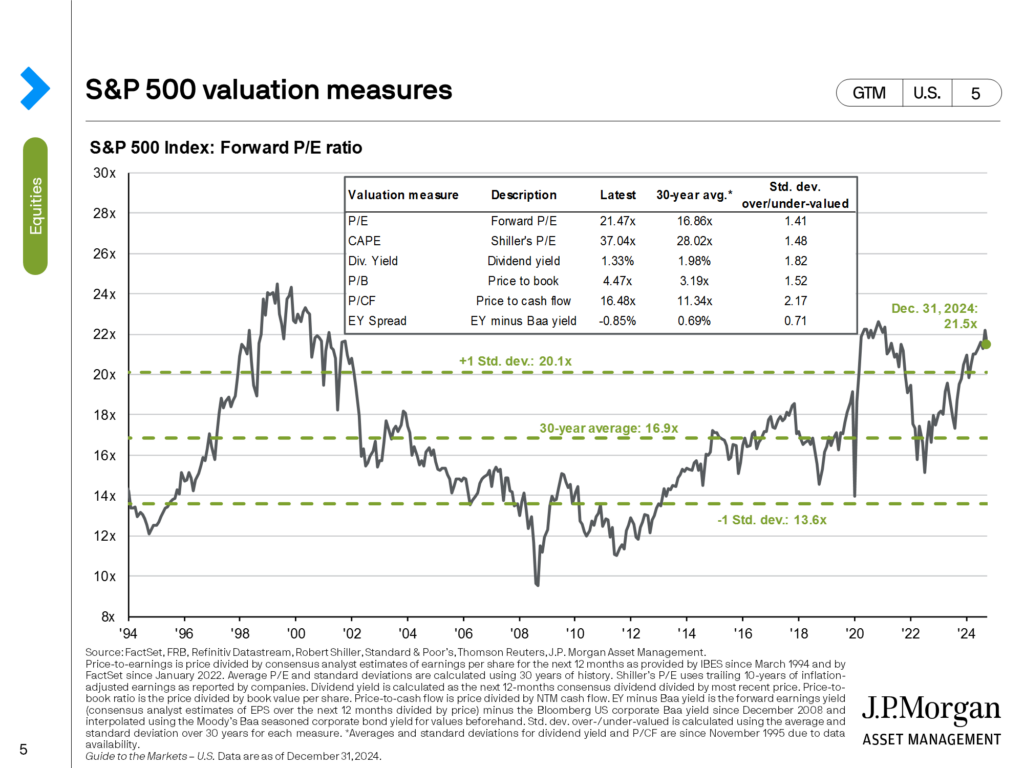

When looking ahead to 2025, fundamentals offer some directional clues. The S&P 500’s forward price-to-earnings (PE) ratio of approximately 22 suggests lower future growth potential. However, forward PE often struggles as a precise predictor of returns, so it serves more as a general gauge of expectations.

Instead, consider the broader relationship between earnings trends and index prices. Based on projected 11–17% earnings-per-share (EPS) growth rates in 2025 and 2026, forward PE multiples give us a framework for market potential. Using an estimated EPS of $275 for 2025 at a forward PE of 22, the S&P 500 could target 6,055, aligning closely with recent highs. For 2026, projected EPS growth to $311 gives a potential range between 5,598 and 6,842, depending on forward multiples from 18 to 22. At midpoint, this suggests a 5.8% average gain for 2025.

Economic Indicators to Watch

Economic data adds complexity to the outlook.

- Industrial production is slowing, flashing caution.

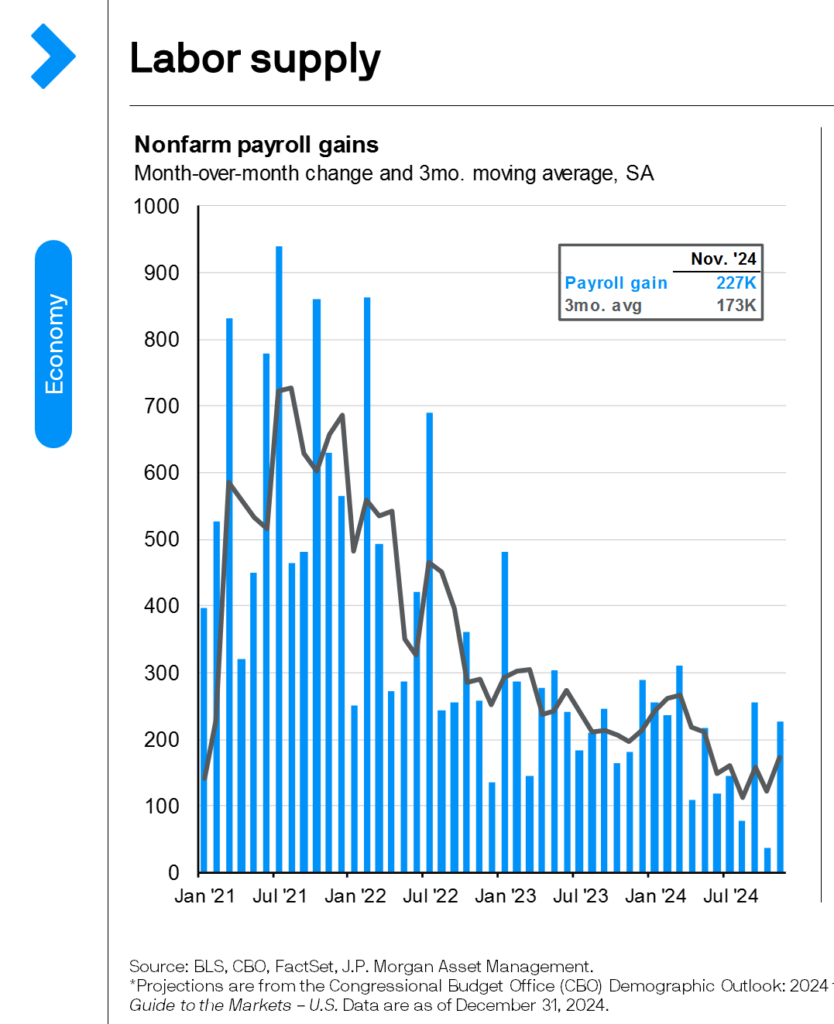

- Employment metrics have continued to weaken for 19 months straight.

- Inflation and interest rates remain higher than desired, pressuring households and debt-sensitive businesses.

While personal income recovery boosts consumer spending, household debt is inching higher, personal savings are lower, and real estate remains sluggish. These mixed signals suggest vigilance is critical. Especially when looking at employment data as a significant increase could disrupt consumer spending, GDP, and overall economic momentum.

Technical Analysis for 2025

From a technical standpoint, 2025 might begin with a pullback. High yields and rising dollar strength have weighed on equity markets recently. Risk-off indicators predict a correction, with potential declines of up to 10% for the S&P 500 early in the year. Despite this, the longer-term technical bull trend remains intact, supporting recovery later in the year.

For bonds, there’s reason for optimism. Surging yields, while challenging for stocks, could stabilize. If that happens, bond portfolios could see positive NAV growth, with potential annual returns in the 7–10% range.

Regarding equities, U.S. markets currently show stronger prospects than international allocations. The impact of potential policy changes shaped by presidential election will also play a key role in international performance.

The Big Picture

Overall, 2025 is shaping up to be more volatile with heightened uncertainty around policy, inflation, and rates. While earnings strength remains a positive indicator, much of this growth appears to already be priced into the market. Charts suggest a pullback early in the year, but the long-term bullish trend gives reason for optimism later on.

Target Returns

For 2025, mindful allocation could lead to mid-to-upper single-digit S&P 500 returns, with bonds providing added stability and potential upside. While predictions offer ranges (e.g., -4.8% to +16%), they emphasize potential directions. A return in the range of 8% would mark a successful year.

Final Thoughts on the Market Outlook in 2025

The market outlook always carries uncertainty. Key economic indicators, earnings trends, and technical signals provide valuable guidance, but unexpected global events and policy shifts can change the course rapidly.

Stay vigilant, position your portfolio with calculated risks, and prioritize balance in your strategy. Reassurance comes from stepping back to focus on long-term alignment rather than short-term noise. Remember, investing is a marathon, not a sprint. A measured approach rooted in thoughtful analysis will always serve you well.