Our Investment Philosophy

We think a lot about portfolios — I mean a lot. It is our job after all. How do we think? What framework do we use to stay focused and provide consistency? With literally 1000s of different strategies, techniques, and methods to manage investments, it can be overwhelming to choose. However, there are time tested principles that will serve any investor well to follow. Our investment philosophy credo has six core tenets that guide our strategy. This is how we think:

- We are investors vs. speculators

- We stay invested

- We believe loss of buying power is the real risk

- We prefer owning vs. lending

- We trust long-term economic data vs. industry opinions

- We design portfolios differently for retirement income

We are Investors vs. Speculators

At the heart of our philosophy lies a profound belief in the power of growing global economies and the compounding returns offered by public investment markets. Our focus is not merely on storing wealth but compounding it for future use. We prioritize high quality, consistency, and predictability. The goal is not merely to chase high returns, but to protect clients from wasting time waiting for the perfect time to invest.

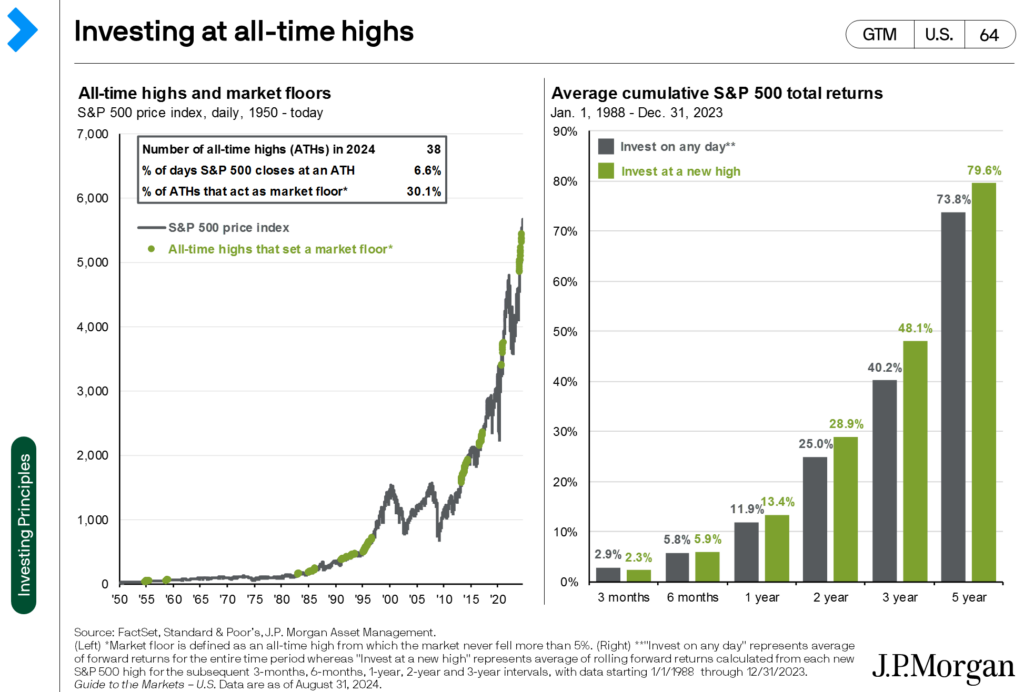

The chart illustrates that not only do new all-time highs in the stock market tend to beget more news highs (1), but it also doesn’t matter what day you pick to invest (2) — odds are you will see a positive return within a year.

We Stay Invested

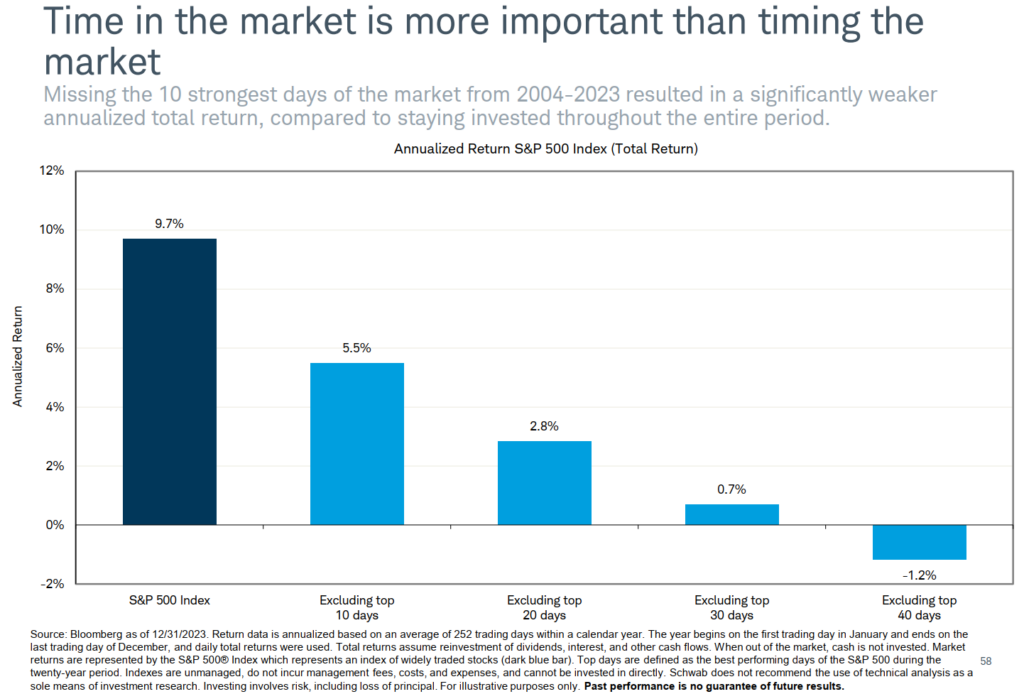

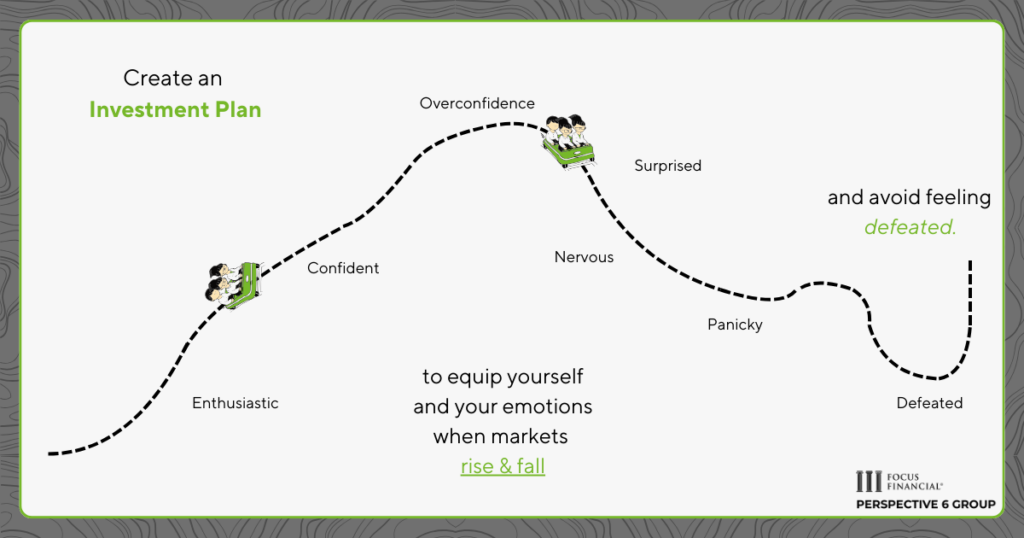

We invest for decades not days. This requires understanding that investing has by its definition a long-term horizon. It requires time in the market over timing the market.

While attempting to precisely predict market movements is a futile game that creates more risk than reward, there are times that adjustments are prudent. We liken our philosophy for investment to driving a car —always moving forward, never parked. Based on current economic indicators we may approach portfolio risk differently.

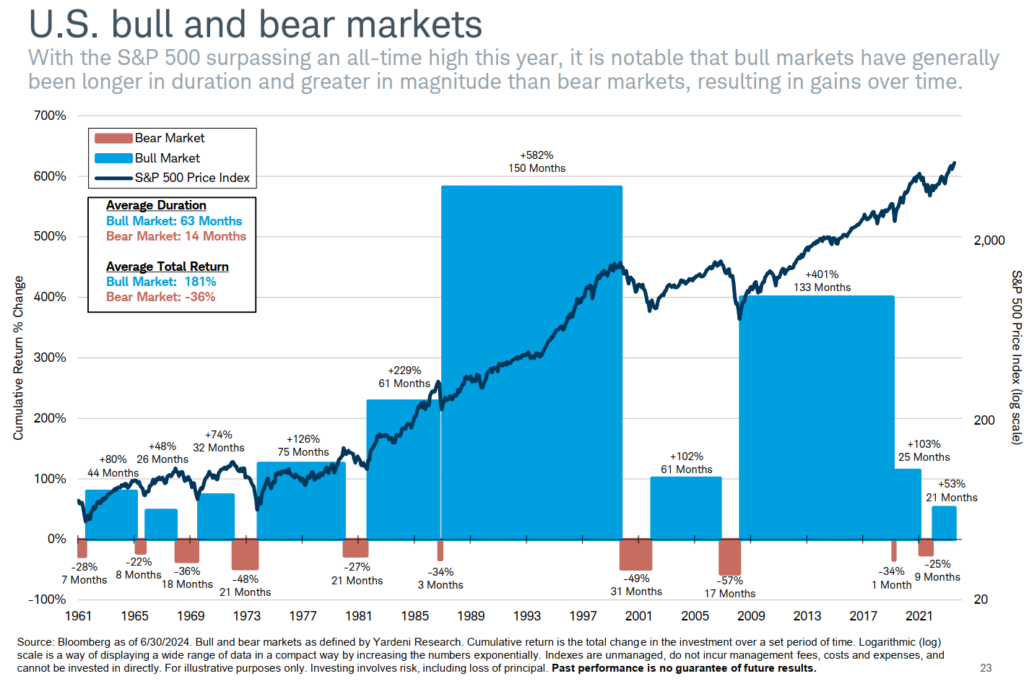

- Foot on the Gas: Buying more stocks after the market declines is much more successful than attempting to sell them at the top. Be bold when others are fearful and understand that bull markets often last much longer than the “gurus” expect.

- Foot off the Gas: While there is rarely a reason to sell all your stocks, adjusting based on economic conditions and long-term goals protects the downside when bear markets are brewing. We believe it is impossible to time a market top, but using caution during market extremes is still prudent.

Over time, the stock market goes up more than it goes down. The chart below shows us that bull markets tend to be of greater magnitude and longer duration than bear markets.

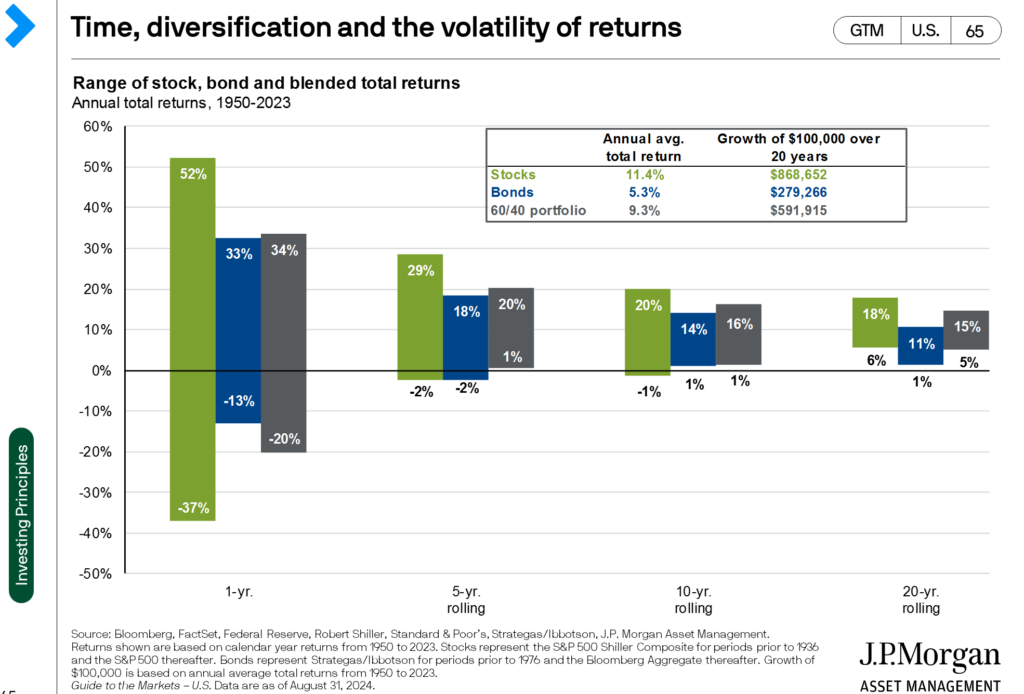

The chart below illustrates the effectiveness of time, diversification and volatility of returns over time. The longer you stick with it, the less risky investments will feel.

We Believe Loss of Buying Power is the Real Risk

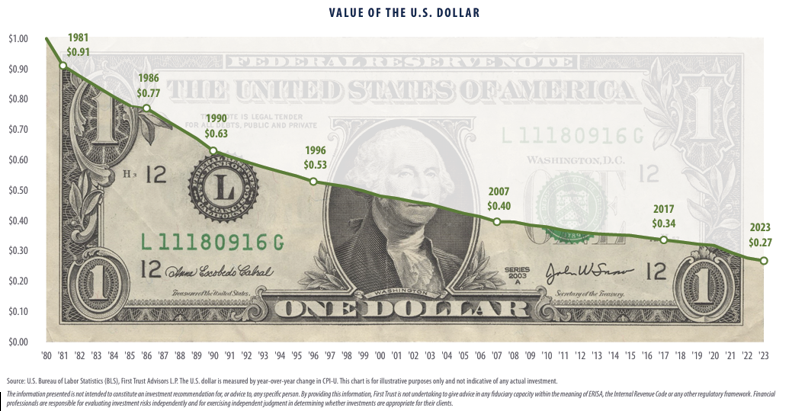

Inflation poses a significant threat to long-term financial well-being, far overshadowing temporary fluctuations in value. We encourage our clients to embrace equity risk, understanding that the loss of purchasing power is the true risk they face. Our approach prioritizes preserving purchasing power over time, ensuring portfolios are resilient to the eroding effects of inflation.

The buying power of one U.S. Dollar in 2023 is only 27 pennies compared to 1980. Basically, you would need $3.70 in 2023 to feel as rich as you did in 1980 with one dollar.

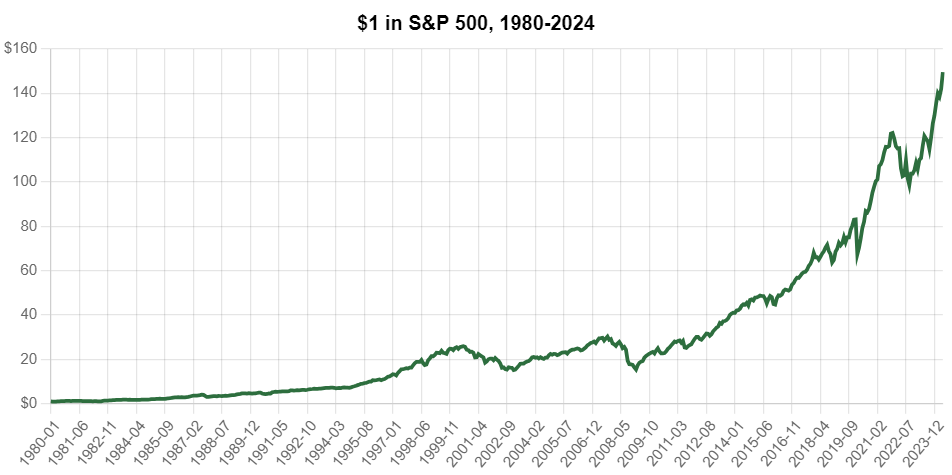

However, if you invested $1 in the S&P 500 at the beginning of 1980 you would have about $130.01 at the end of 2023, assuming you reinvested all dividends. This is a return on investment of 12,900.51% or 11.70% per year which more than offsets the effects of inflation.

We Prefer Owning vs. Lending

Driven by our conviction in the growth potential of well-run businesses, we emphasize owning stocks over bonds. While bonds serve a crucial role in income generation and portfolio diversification, our preference is ownership for long-term wealth creation. We put money to work owning shares of great companies and let capital markets increase value over time. Our goal is for clients to have an investor mindset and own for the upside.

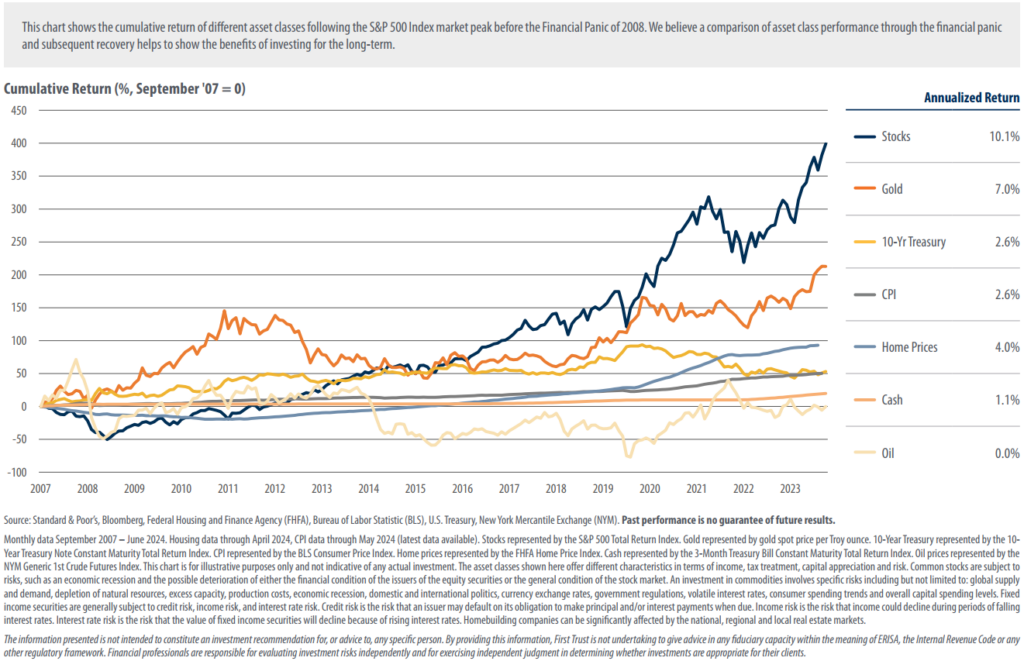

We Trust Long-Term Economic Data vs. Industry Opinions

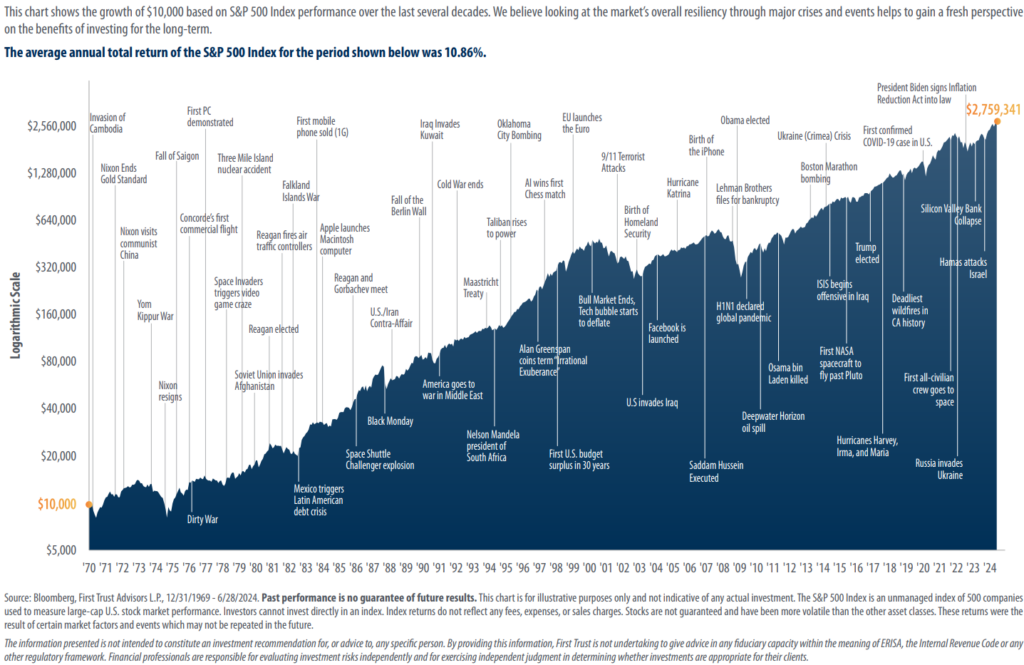

Over our lifetime, we will face dozens of market crises, political scandals, geopolitical events, and other tense environments.

Amidst this noise, we anchor our decision-making process in long-term economic data. Since guru opinions and industry norms often fall short, we strive to remain agnostic, embracing a data-driven approach. This helps keep clients focused on the big picture with a plan to handle short-term noise.

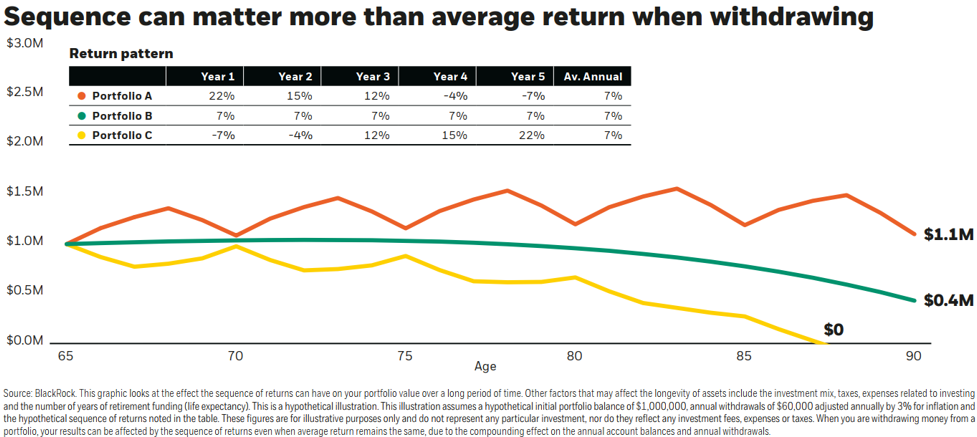

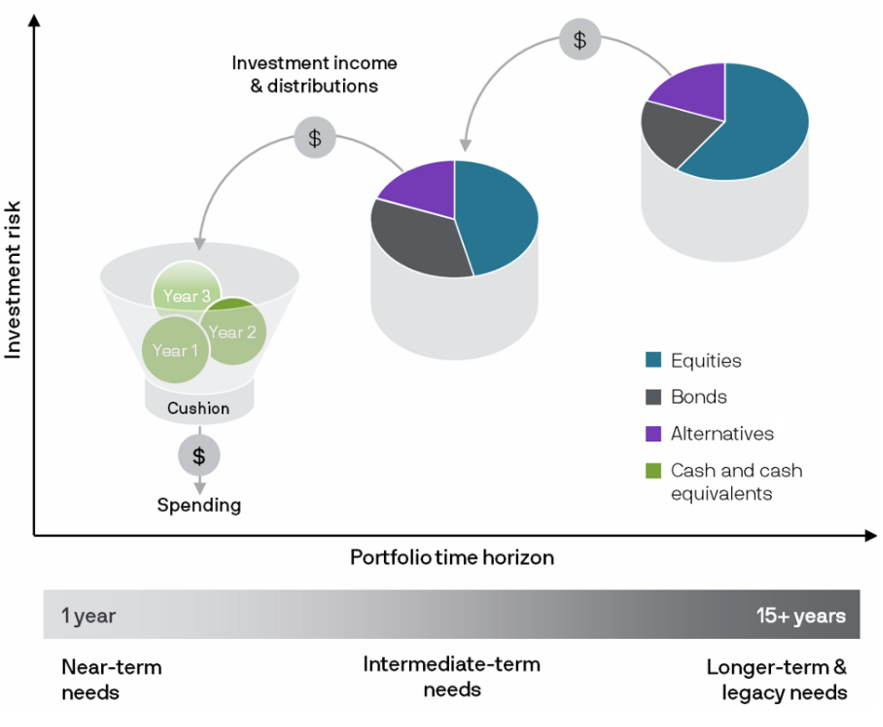

We Design Portfolios Differently for Retirement Income

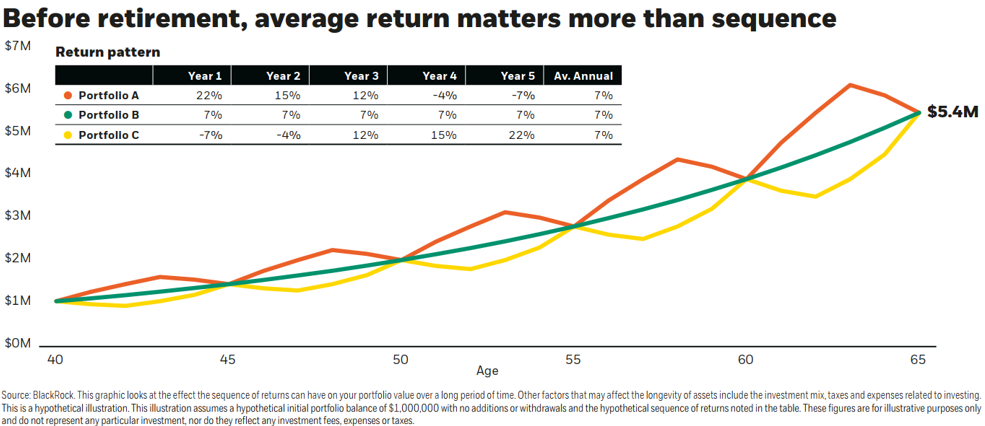

Retirement income planning requires a tailored approach, emphasizing the need for stable income streams over simple growth. How a portfolio achieves returns matters more during the spending phase than during the saving phase.

This is why we use a “needs-based” asset allocation approach. The aim is to protect essential income while continuing to invest in stocks to combat inflation and loss of buying power. We use a strategy to protect near term cash needs while being able to keep our “foot on the gas” with the remaining portfolio. By aligning investment strategy with income needs, the goal is to provide financial security and resilience in retirement.

For illustration, 3-6 years of short-term income needs could be set aside in cash equivalent assets. The remaining portfolio is apportioned in stocks, bonds and other investments for growth with intent to refill the cash equivalent portion on regular basis.

Our investment philosophy serves as a framework that keeps us focused and consistent. It shapes every portfolio decision and recommendation we make. By following these principles, we strive to navigate the complexities of the financial landscape with clarity, purpose, and resilience, empowering our clients to achieve their long-term financial goals.