Key Retirement Plan Contribution Limits for 2025

Here we are again, it’s close to year end and that means we have some new retirement plan contribution limits to pay attention to heading into 2025. Let’s take a look at what is changing!

401(k)/403(b)/457 Plans:

Per usual, workplace retirement plans such as your 401(k) will see a slight increase in contribution limits. For 2025, the elective deferral limit will be set at $23,500 which is a $500 increase from 2024.

However, there is a big change happening when it comes to “catch-up” contributions. In the past there was only one age to pay attention to in regard to “catch-up” contributions, that age has typically been age 50. But now there are two “catch-up” ages to pay attention to.

Here is the breakdown:

- Those aged 50 and above will be eligible for a catch-up contribution of $7,500

- Therefore, as an employee you could potentially contribute $31,000 to your 401(k) between your normal deferral of $23,500 and your catch-up deferral of $7,500

- Thanks to the Secure Act, those ages 60, 61, 62 and 63 have a higher catch-up contribution limit. This new limit is $11,250 instead of $7,500

- Therefore, you could contribute a whopping $34,750 to your 401(k) if you fall between the ages of 60-63

Traditional IRA and Roth IRA:

Normally we would see contribution limits increase for Traditional IRA and Roth IRAs but that is not the case heading into 2025. The contribution limits for these accounts will remain the same as 2024 at $7,000. Those above age 50 do still have the option to make a catch-up contribution of $1,000 for a total of $8,000.

Remember, the contributions limits are per person not per household. Also, another important item to keep in mind is that your contributions to a Traditional IRA and Roth IRA are aggregated together, meaning you can’t fund more than the max of $7,000 combined between the two accounts.

SIMPLE IRA:

Simple IRAs will see a small increase in maximum contributions. For 2025 the contribution limit is now $16,500. Those 50 and over are eligible for a catch-up contribution of $3,500 for a total of $20,000.

Now with Simple IRAs we have a second catch-up contribution limit to pay attention to. Much like with 401(k)s, Simple IRA owners now have an extra catch-up that applies for those ages 60-63. This new catch-up limit is $5,250 for a total of $21,750.

SEP IRA:

SEP IRA contribution limits will be increasing to a max of $70,000 in 2025. This is up from $69,000 in 2024. Remember that SEP contribution limits are also tied to a percentage of your compensation with a max contribution of 25% of compensation. This means to hit the full max of $70,000 you would need to earn $280,000 in 2025.

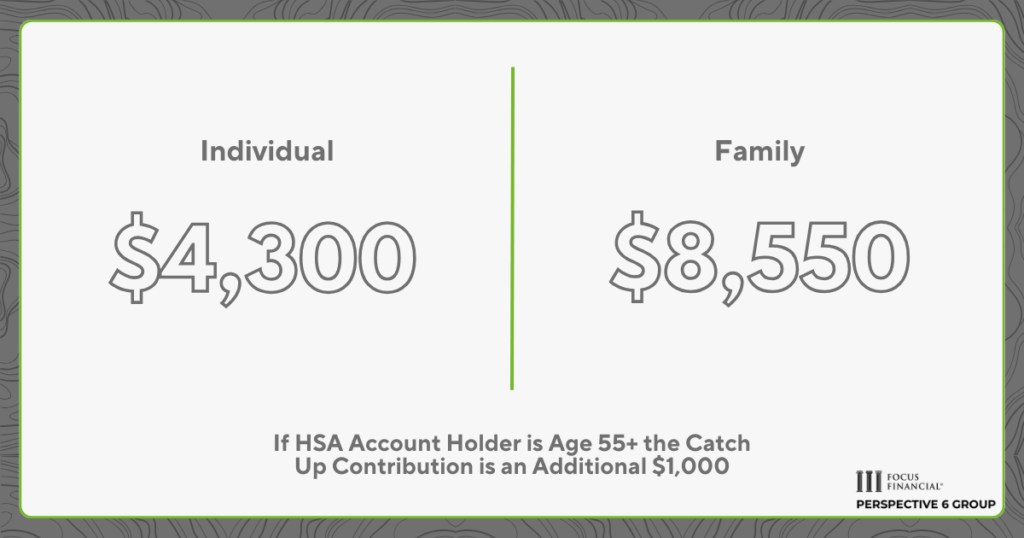

Health Savings Accounts (HSA):

Health Savings Accounts will see a new max contribution heading into 2025. For individual health plan owners with an HSA the limit is $4,300. For families with a family health plan the HSA limit is $8,550. Those 55 and older have a catch-up contribution of $1,000.

IMPORTANT: The $1,000 catch-up contribution is per plan not per person, meaning a family with two spouses will receive one catch-up amount of $1,000 for a total of $9,550.

Resources:

For a printable PDF of the 2025 contribution limits, tax info, as well as other key numbers – Click here!

If you have any questions or need assistance updating your contribution amounts, please contact Perspective 6 Group.