Spring 2025 Market Insights

Spring 2025 Market Insights Summary

Economic Outlook

- The positive trends of 2024 have continued into 2025. This appears likely to continue for months to years to come, but not without some choppy water. Economic and policy risk remain at the forefront and could affect economic projections.

Portfolio Position

- While we spent the last year at a “full bull” portfolio stance, we have elected to trim back some of the risk in the portfolios. We are doing this to capture the excess gains and to take advantage of what we believe to be a potentially strong year for bonds. This move reduced equity holdings by about 10% after capturing an excess return of approximately 4%. Further, it allows us to reduce the portfolio risk in a time of policy uncertainty while maintaining our long-term bull stance. As we continue to wade through a changing economic and political climate in 2025 further risk reduction remains a possibility.

Key Economic Factors for 2025

Solid Footing Ahead

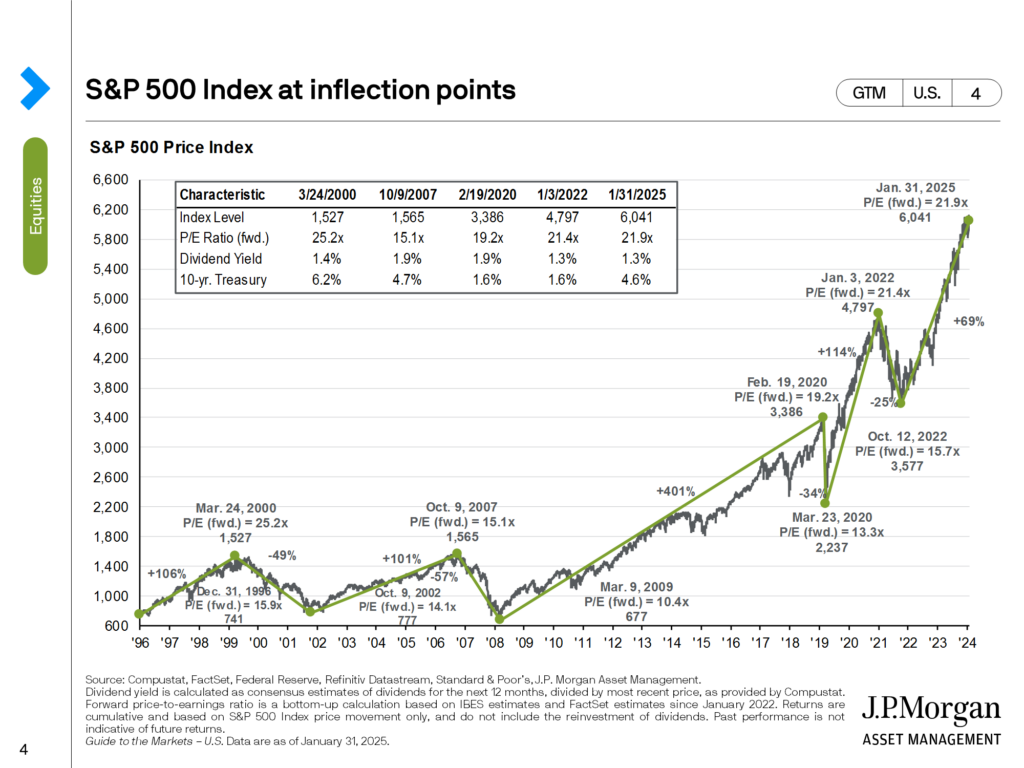

Going into Spring market earnings continue to impress with growth estimates at 14% in 2025 and 13% in 2026. Long-term earnings are the key driver of a company’s stock growth and subsequently the stock market’s growth. When we look forward to get a general direction of the markets, earnings is a key component like a rudder on a ship.

Spring 2025 Market: A Quick Glance

- 2025 & 2026 earnings per share (EPS) expectations create a projected EPS of $310 by the end of the year.

- A reasonable 21x earnings multiple places 2026 S&P 500 around 6,500. This becomes our 2025 end of year target or approximately 9% higher from this writing (2/25/2025).

- The stock market future earnings into the current price approximately 6 months ahead. This estimate is a general rule of thumb and not an exact math calculation.

- With bond yields expected to continue moving lower, U.S. bond investors are likely to see a positive 2025.

- A 1% reduction in current US Treasury yields will net an approximate 9% return for the bond portion of our investment portfolios.

- After a historical 4-year run of low to no returns on bonds, this is a welcome “return to normal”. It will allow us to reduce portfolio risk while maintaining strong return expectations.

Historically we are still at least 30% away from the bull market cycle ending. Bull markets historically average 51 months in length and 162% return from trough to peak. We have spent 16 months in the current expansion cycle. That should place the bull market at another 30% to 100% return before a recession begins. However, there are plenty of examples of bull markets lasting less than 24 months.

It is our stance that history is a great guide, and it often becomes an oracle for us. With that said, it is just a guide and what happens next is never an exact science. There are hundreds of factors that can come into play to cause the market to expand or contract.

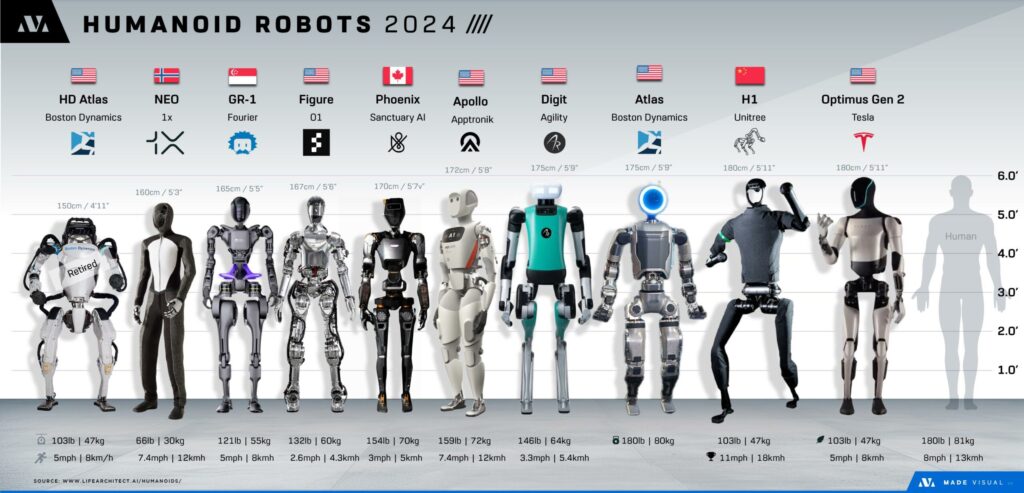

AI is Here to Stay

Not only is AI here to stay, but it will likely dominate our future. From large language models creating efficiencies in our daily lives to autonomous travel, robots and more. AI is positioned to transform how we do things and even introduce completely new technologies never seen before in human history.

For example, autonomous driving is currently on the verge. It is likely to become the norm in automobiles and even flight in the next decade or less. Think about how this will completely transform transportation as well as the ownership of automobiles. Imagine the economic impact if the average household has just one vehicle. Meanwhile, medicine, engineering, and writing are all set to change to benefit their industries as well. For example, imagine having your own in-home humanoid robot that takes care of cleaning, cooking, your pets, etc. Further, transplants for the disabled to walk or see again are already being tested. The immediate future is set to unravel a transformation equivalent to the industrialization of the world 100 years ago! It is going to change our lives as we know it!

Spring 2025 AI Market Projections

- AI annual market growth expectations are between 19-37% over the next decade.

- The global AI market is expected to reach $15 trillion by 2030, with the potential being much higher.

- Historically new areas of growth and technology have created generational market growth opportunities. Further, company growth can be exponential in the short term.

- Overhype and fear of missing out (FOMO) can cause periods of excess returns followed by significant corrections. Quality investments for the long haul are key to balancing out this volatility.

Economic Uncertainties

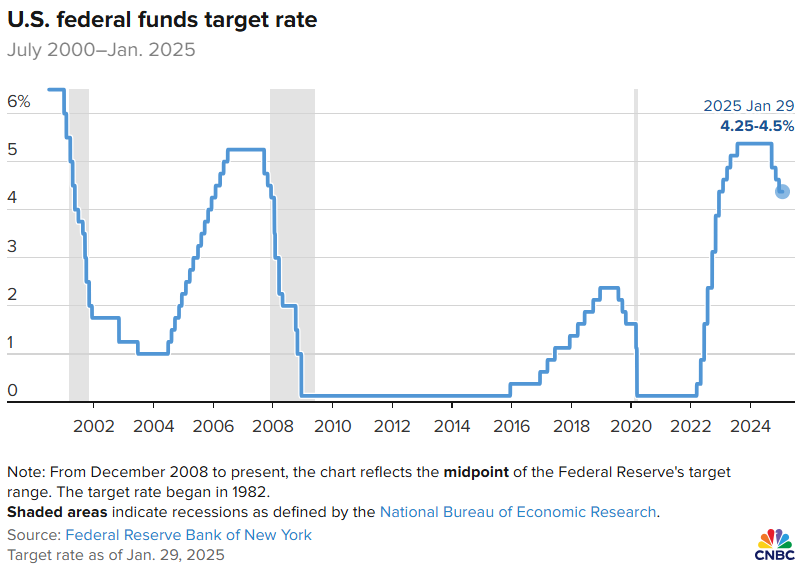

Inflation & Interest Rates

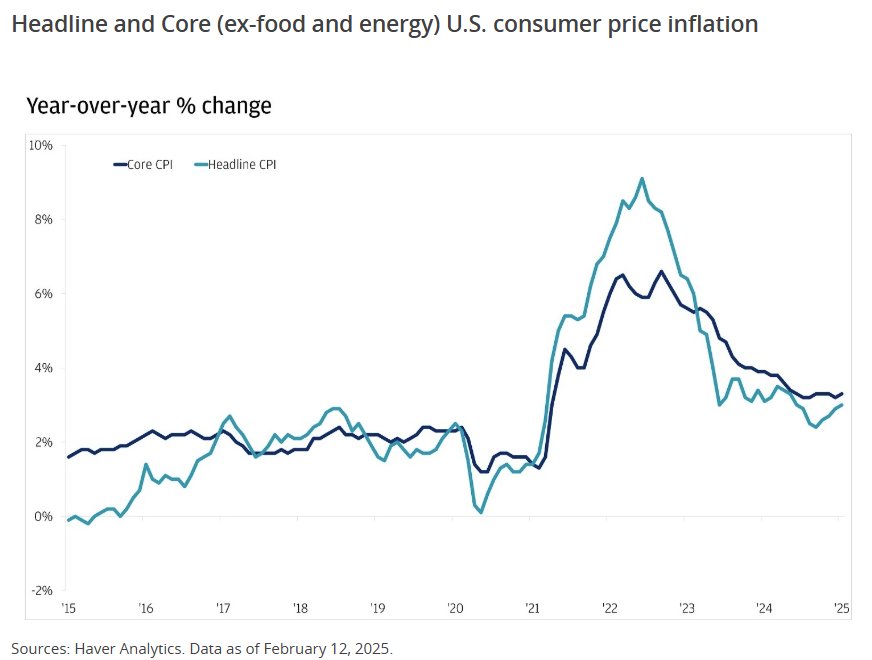

Inflation continues to moderate, but at a much slower rate than the Federal Reserve would like. Consequently, they have reduced the pace of rate cuts. In turn this is causing the stock markets to slow their move higher. In some cases, areas of the market have even retracted as well. Federal policy is a driver in reducing overall rates which ease lending costs for individuals and companies alike. If there is a lower cost to lend, then there are higher profits for companies and households. This typically takes the form of extra cash on hand to pay for goods and services. In turn driving the economy higher on all fronts.

- Current core inflation is 3.3%. This is still over the goal for the Federal Reserve to reduce rates noticeably.

- The current federal fund rate is 4.25%. Which is still significantly higher than the 2.0% target.

- The federal rate will likely normalize around 3% instead of the prior 2% target.

- The elevated rate environment is placing a strain on U.S. businesses and households. If the Federal Reserve holds too high for too long, it can create a negative economic situation and a recessionary environment. We will likely begin to see the impact this year or early 2026.

- The current 30-year mortgage rate is 6.20%. The estimated rate needed is mid-5% to help ‘unlock’ the current housing market.

- A significant reduction in rates is necessary to help revive the housing market. For example, many retirees feel stuck in their current home due to the high interest rates. This results in stuck equity and net worth at a time many need it to begin enjoying retirement.

Unemployment Market in Spring 2025

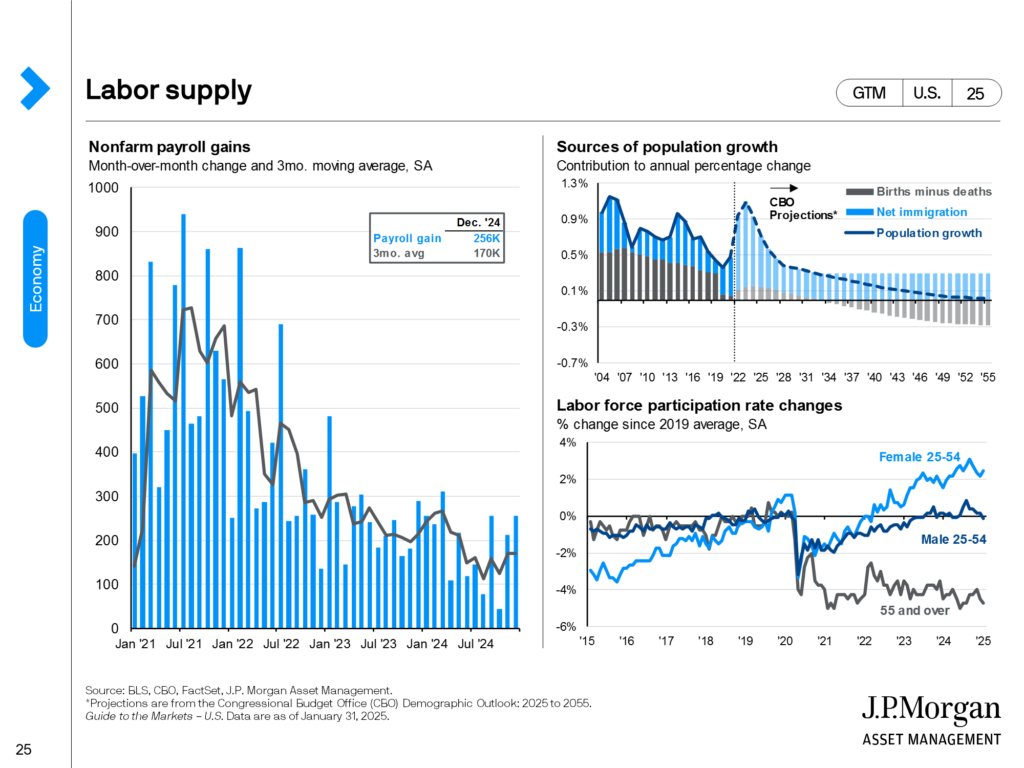

Unemployment continues to lag in a moderately worrisome trend. There has been a continual down trend on the monthly non-farm payroll data. These significant negative past revisions are casting doubt on the health of the economy and the consumer. To have a long-lasting economic growth cycle, this trend needs to reverse in 2025. Currently, there has been a 43 month-long down trend despite a strong economy and stock markets.

Policy Changes

Policy risk remains the biggest area for potential change in 2025. Defined by the potential negative impact on economics due to regulation, law, and policy changes. A new administration always brings a level of uncertainty and change. With President Trump, that has heightened to a level not seen since his first term.

Tariffs

Tariffs are a rate charged on the import of goods from other countries or industries. Currently, nearly 100% of foreign countries levy a tariff on U.S. goods exported to their countries. Tariffs can generate income on the federal level but cause a temporary disruption in the prices of materials and goods being imported. Economically, tariffs are NOT inflationary. Real inflation is a symptom of the devaluation of currency and not short-term supply and demand mechanisms.

The bulk of the cost of tariffs is often shared by the importer and exporter of the goods. Importers may look to renegotiate terms with the current exporter. However, an importer will typically shift their purchasing to lower tariffed locations or domestic non-tariff suppliers. An increase in investment of U.S. manufacturing and employment is a desired end result of the administration.

The DOGE Effect

Cleaning up the federal budget was one of the mandates President Trump ran on. That takes form via the DOGE mechanism. We will not discuss the setup, merits, etc. but the impact of the changes being made. Significant cuts in federal spending are both good and bad for the U.S. economy.

The Bad

U.S. federal spending accounts for 23% of our GDP. Prior to COVID, federal spending was about 20% annually. If there are significant cuts, it will subsequently reduce our GDP and slow economic growth. The private sector then absorbs this, but not overnight. The significant reduction in employment federally will flood the private job market with unemployed people. Therefore, there may be a short recession environment due to the speed of fiscal cuts and unemployment.

The Good

The goal stated by the administration is to cut one trillion in spending by the end of 2025 and up to two trillion overall. Some of this will be waste and potential fraud in the system while the rest will be downsizing the federal government. Again, 23% of current spending is nearly one trillion over pre-COVID levels alone. Long term, a reduction in federal spending is good for the U.S. economy. We will see a reduction in Bond rates and a long-term increase in growth and prosperity.

Geopolitical Upheaval

If there is one thing we know, President Trump is disruptive to the geopolitical scene. This has become heightened with the threat of tariffs. Tariffs, peace negotiations, threats of taking over Canada or Greenland should all be seen as nothing more than that, threats. Watch out for final agreements vs. what he or his administration says.

Geopolitical tensions matter less to our economy and markets than tariffs. However, they can still cause a shift in market sentiment in the short term. Always watch the facts, not the noise.

Resources for Spring 2025 Market Insights

Have additional questions you need answered? Reach out!

2025 Market Outlook: Insights on Navigating Volatility

Social Security in 2025: Separating Fact from Fear

Guide to the Markets 2025 – J.P. Morgan

Disclosure: These opinions are based on our own observations and third-party research, and are not intended to predict or depict performance of any investment. These views are as of the open of business on 2/25/25 are subject to change based on subsequent developments, and are not intended as investment advice or to predict future performance. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. These views should not be construed as a recommendation to buy or sell any securities. Past performance does not guarantee future results.