Key Retirement Plan Contribution Limits for 2024

With the 2024 quickly approaching, the IRS has provided updates to retirement plan contribution limits. If you or your spouse are still working, then you may want to update your contribution amounts to ensure you are on track to hit these new limits. Now, let’s dive in and see what has changed!

401(k)/403(b)/457 Plans:

The standard contribution limit will see an increase of $500 from last year to a total of $23,000. Keep in mind that this contribution limit combines both pre-tax and Roth deferrals.

In addition to the standard contribution limit, those over the age of 50 will also have an opportunity to make a catch-up contribution up to $7,500. In simplest terms, those over age 50 can contribute up to $30,500 for the 2024 tax year (again this limit combines both pre-tax and Roth deferrals).

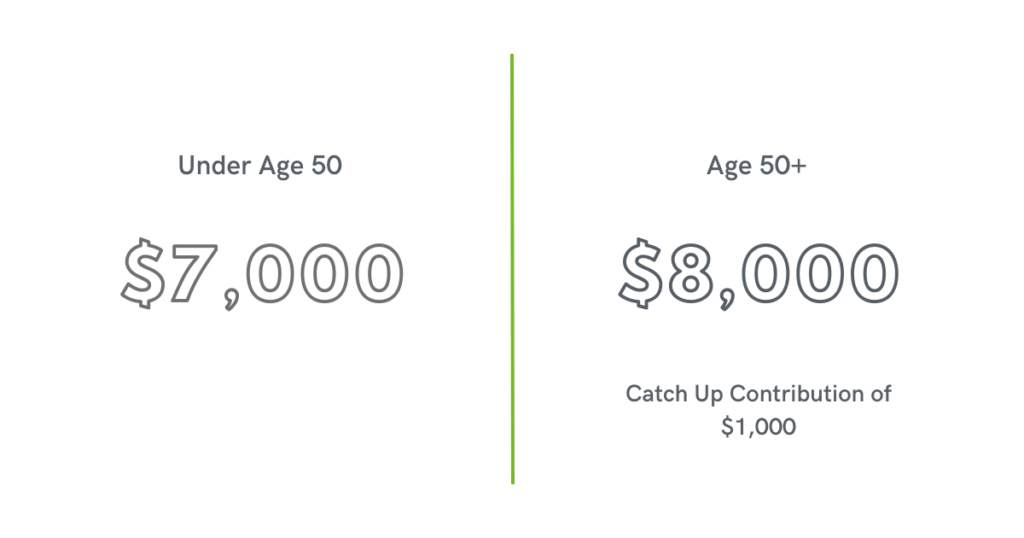

Traditional IRA and Roth IRA:

The maximum contribution for Traditional and Roth IRA accounts has also increased by $500 in 2024 to a total of $7,000. Further those over the age of 50 are eligible for an extra contribution of $1,000 as catch-up contribution for a total of $8,000 for 2024.

A few important notes to keep in mind regarding Traditional IRA and Roth IRA:

- The contribution limits are per person not per household. Meaning both spouses can contribute the maximum or $14,000 ($16,000 if both spouses are over age 50)

- The maximum contribution combines your contributions to both types of accounts, see example:

- Under age 50 and contribute $7,000 to Roth IRA – ALLOWED

- Under age 50 and contribute $7,000 to Traditional IRA – ALLOWED

- Under age 50 and contribute $3,500 to Roth IRA and $3,500 to Traditional IRA – ALLOWED

- Under age 50 and contribute $7,000 to Roth IRA and $7,000 to Traditional IRA – NOT ALLOWED

- Both spouses are allowed to contribute even if only one spouse earns income in the year

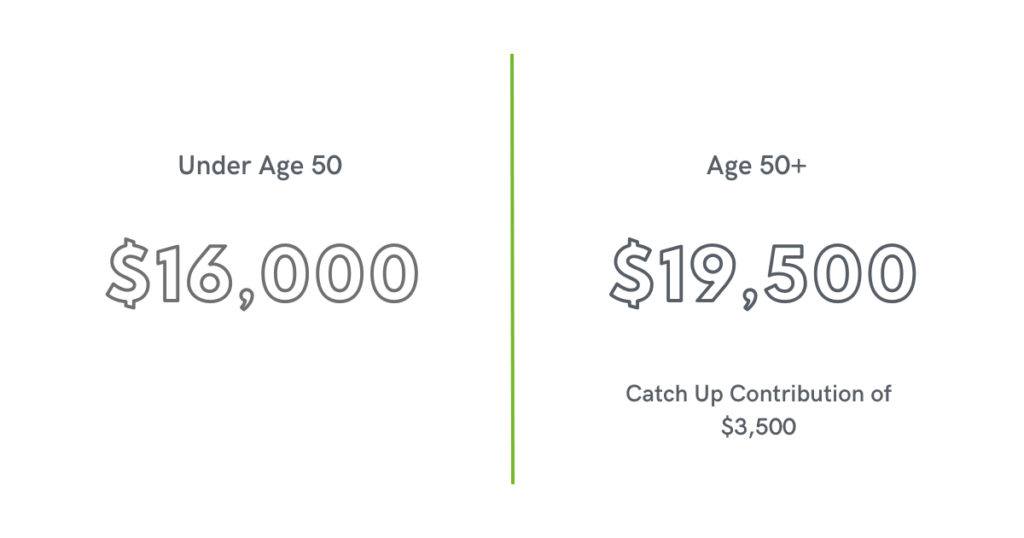

SIMPLE IRA:

In 2024 you can now contribute $16,000 to your SIMPLE IRA if under age 50. A $3,500 catch-up contribution is allowed for those over age 50 bringing their 2024 maximum contribution to $19,500.

SEP IRA:

The contribution limit for 2024 is the lesser of 25% of compensation or $69,000. There is no catch-up contribution associated with SEP IRAs.

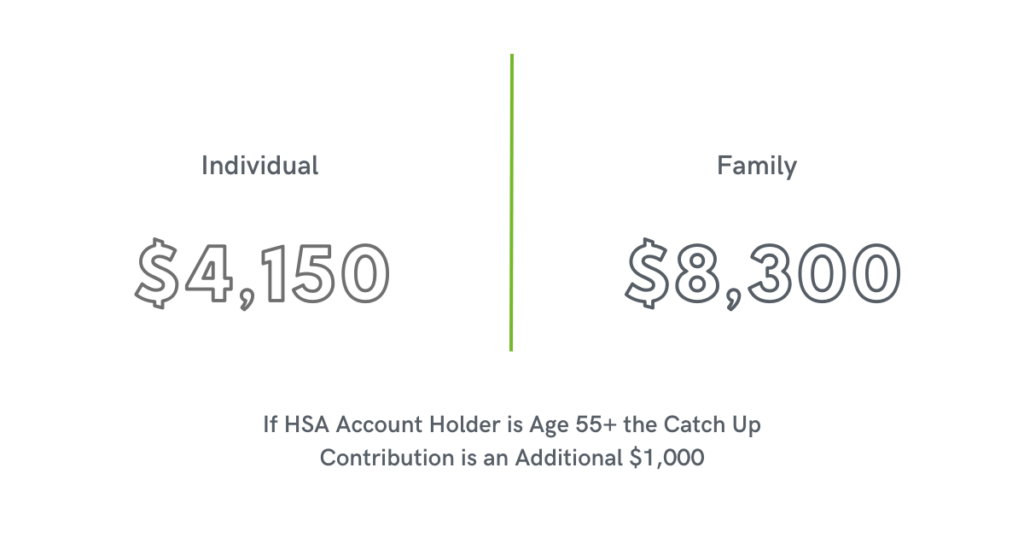

Health Savings Accounts (HSA):

For those with individual health insurance and compatible HSA plans, the individual contribution limit to an HSA is $4,150 in 2024. For family plans that are compatible with an HSA the 2024 contribution limit is $8,300. If you are age 55 or older you are eligible for a catch-up contribution equal to $1,000.

IMPORTANT: The $1,000 catch-up contribution is per HSA account not per covered family member. Also, the $1,000 applies only if the HSA account owner is the one that is 55 or older. i.e. if a covered family member is 55 but not the HSA account owner then the $1,000 does not apply.

Resources:

For a printable PDF of the 2024 contribution limits, tax info, as well as other key numbers – Click here!

If you have any questions or need assistance updating your contribution amounts, please contact Perspective 6 Group.

Other rule updates for 2024: