Reflecting on 2023: Market Insights and 2024 Outlook

As 2023 comes to a close, I’d like to offer up some good news! Currently, the S&P 500 is up 23% while the Dow Jones is up 12% on the year. The market outlook ahead in 2024 is hopeful!

Entering the Fall of 2022, we began to be cautiously optimistic about future market returns. Our team maintained that optimism through much of 2023. Our strategy gradually leaned towards equities, with a bullish move solidifying by late October 2023. For a variety of reasons discussed at our client reviews in 2023, we maintain that optimism heading into 2024. However, we are still cautious on several factors. Looking ahead to 2024, our stock market outlook anticipates more moderate returns in the mid-single-digit range.

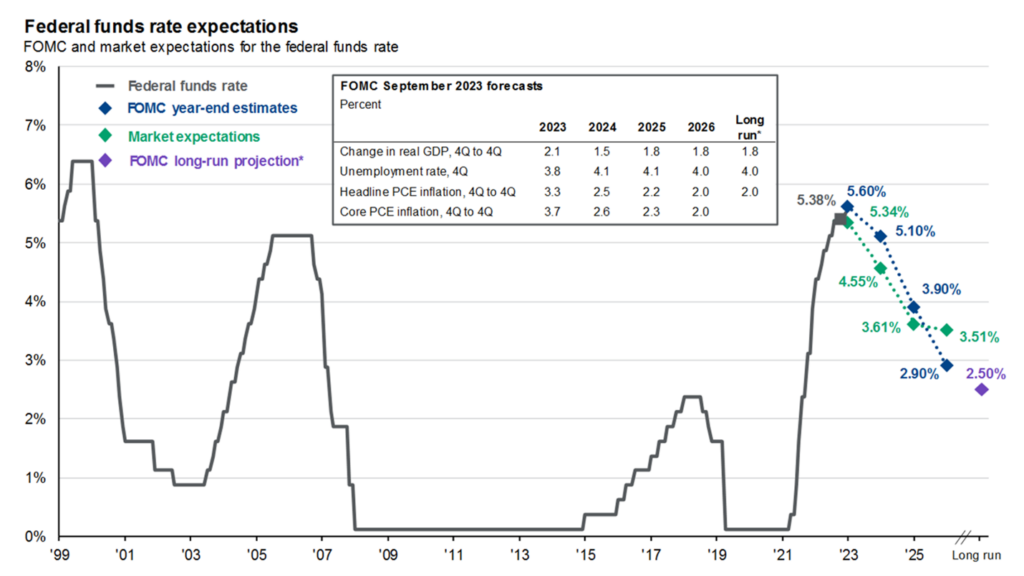

As you recall from the Fall Market Update, both the U.S. bond and stock markets have been mostly driven by inflation and the Federal Reserve policy of raising rates. As 2023 concludes, the rate increases have also likely finished for the year. However, the focus on this policy will remain. The Fed’s decision to reduce rates will directly influence market volatility.

Currently, the expectation for the first rate reduction is late spring/early summer, followed by incremental decreases throughout the year. The crucial question is whether rate reduction aligns with inflation easing or if an economic slowdown forces the Fed’s hand. If it’s the first, then we will have a smoother economic tailwind picking up. If it’s the later, we may have some market volatility. The distinction matters, as an economic stumble might trigger market volatility before the Fed intervenes, termed as a soft or hard landing in financial circles.

Optimism Ahead

At Perspective 6 Group, cautious optimism underlies our outlook on the market for 2024 for several reasons:

- Market valuations, by historical metrics, hover around average levels. This indicates a fair market value despite recent price surges. Fair valuations generally don’t trigger market selloffs.

- Positive corporate earnings projections for 2024 after a lackluster 2023 suggest potential market growth. Analysts foresee an 11% earnings growth this year, which typically implies stock market growth over time.

- While a handful of top stocks drove the S&P 500’s performance in 2023, other stocks are beginning to catch up. This shows promising market depth even if the top-tier stalls in 2024.

Risks We Are Monitoring

We will continue to watch for risks in 2024 including:

- A strong but slowing job market

- A pinched consumer due to significant inflation (net increase of 19%)

- Interest rate risks on both the Federal deficit as well as bank balance sheets

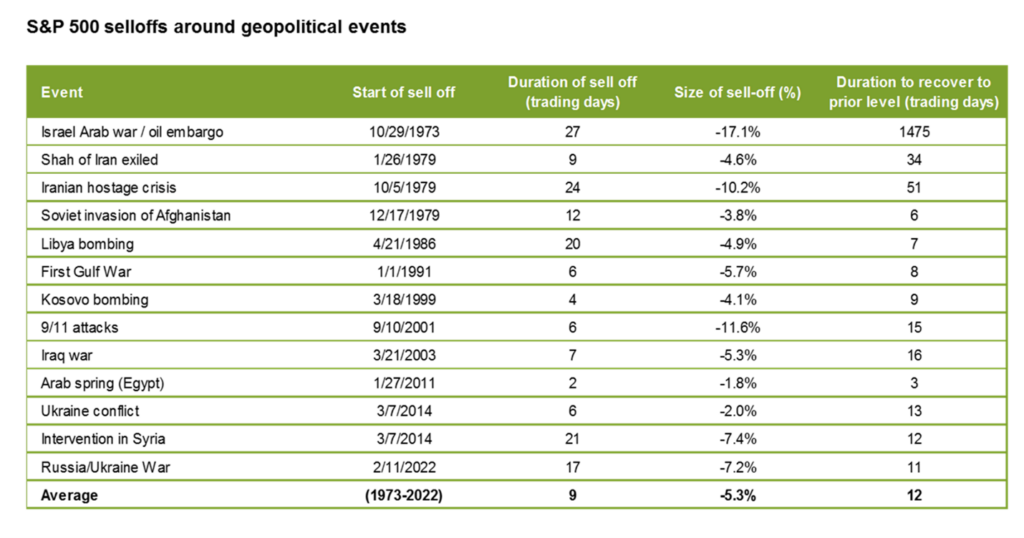

- Geopolitical events disrupting global economies (see chart above)

While a 2024 recession remains a possibility, we still believe those concerns continue to be a lower probability event based on the current market.

Charts credited to J.P. Morgan’s Guide to the Markets.