S&P 5000! What’s Next?

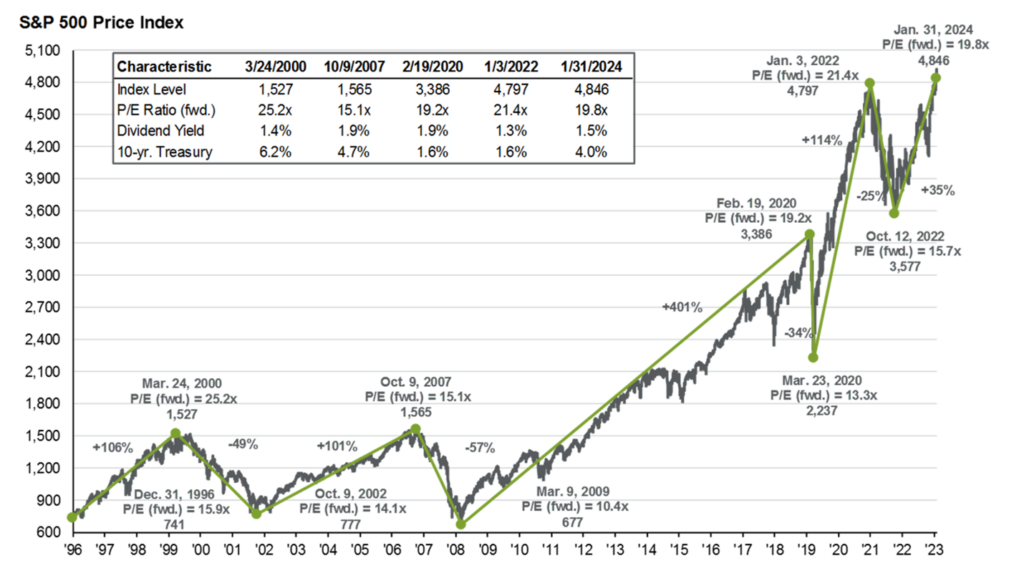

Wow, what a nice start to 2024! As of this writing, the S&P 500 is at the 5000-point mark (S&P 5000)! Further, the market is nearing the year end price targets for most Wall Street firms. As of February 8th, the S&P is up 4.77% YTD and has defied much of the concerns in the economy and markets. The consensus target to start the year was 5,090 representing a little under an 8% growth target. Many large firms were signaling a 0% or even negative growth year while many smaller firms were more optimistic about growth. Regardless, here we are 6 weeks into the year and touching that consensus target.

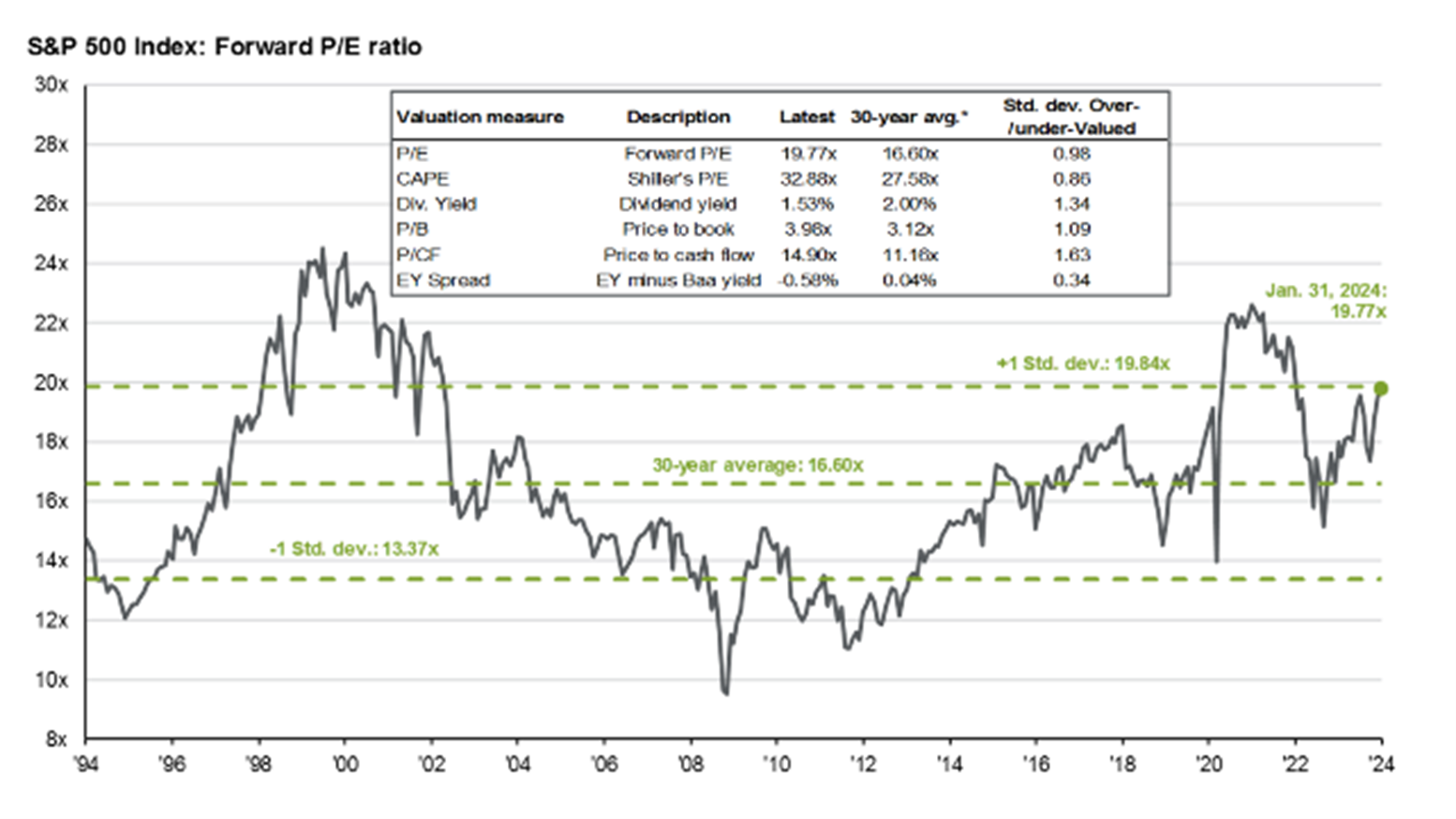

Does this mean anything? Does the target need to be set higher? As our team analyzes and determines our expectations, we rely heavily on economic data and historical trends to guide our economic and market beliefs. While speaking to an estimated window for the year’s growth, we are focused mostly on the direction and strength of that trend. In general, starting 2024, our team carried the thesis over from 2023 of cautious optimism. Despite sitting at S&P 5000 we continue to hold that view.

Our Thesis

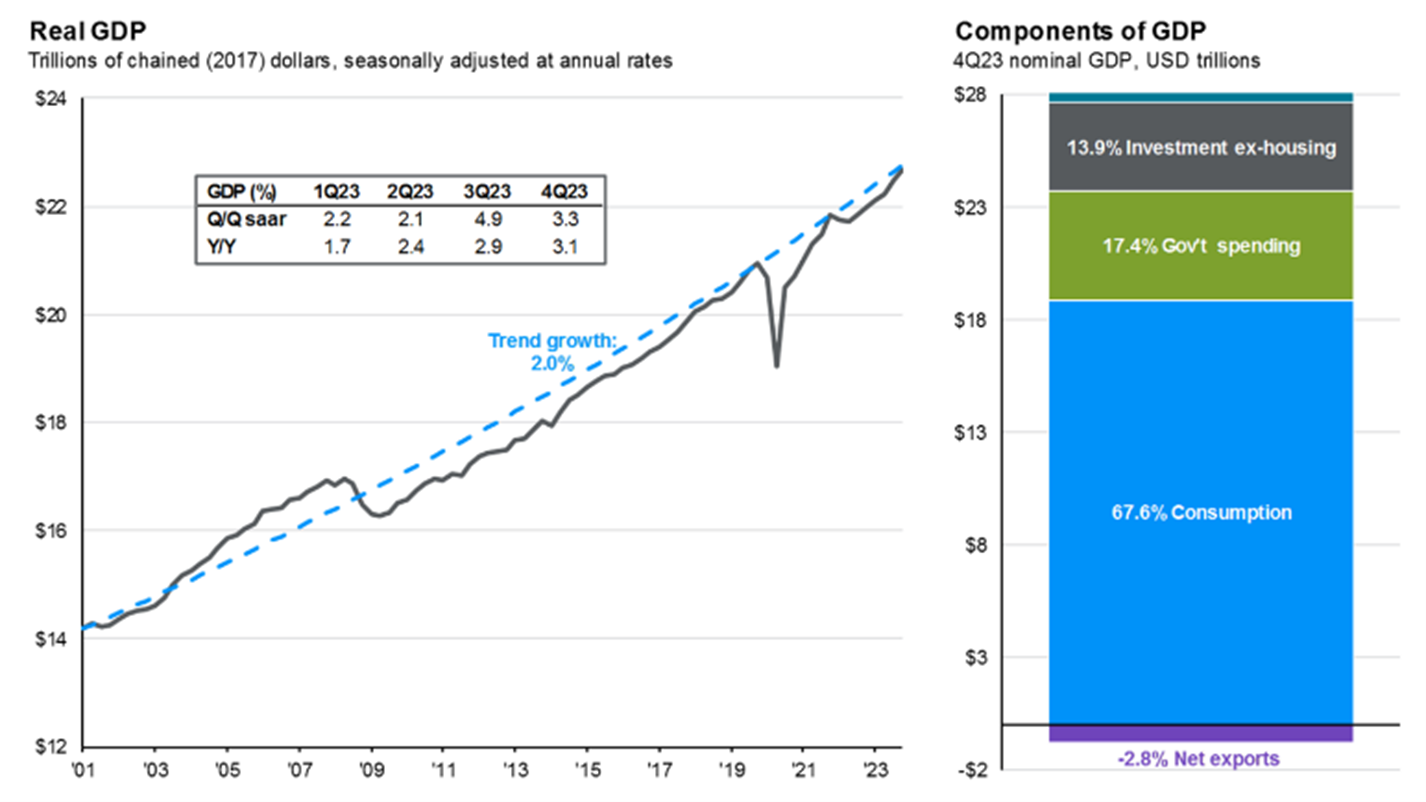

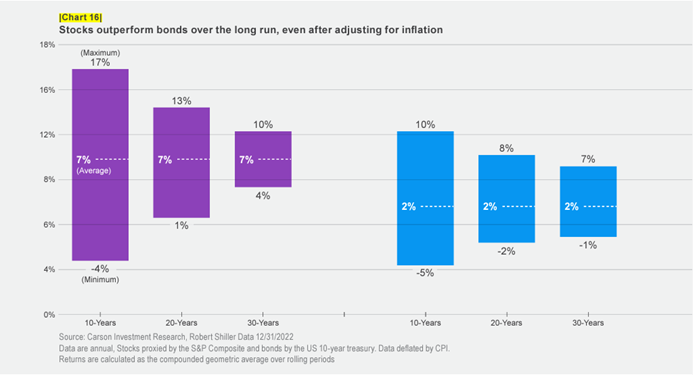

The great part about our strategy is it does not rely on projections of market return to determine specific investments. As an investment firm, we are in this for the long haul. Now, what does that mean? We believe in the economic power that the United States market is powered by innovation, consumption, and a significant percentage of the world’s largest companies. If there is a growing economy, the stock and bond market will also grow. Now that is a very simplified viewpoint and explanation of our thesis.

However, at the core Perspective 6 Group believes in the US economy and its long-term growth. Further, we also trust that the US stock and bond markets will provide growth over years vs. days. In doing so, when economic data shows to maintain investment that is what our team will do. Then, slant into and out of our risk metrics based on the long-term economic changes and characteristics.

At the end of the day, what analysts predict is for their firm’s benefit and not necessarily yours. This can give insight into why they believe in their results but often it is based on the products their firm sells more than being accurate in their predictions. For our case, we want to share our thoughts to prepare clients for what we think is ahead. However, overall, we want to have our eye to the long-term directions and attempt to eliminate the short-term noise that plagues most investors’ minds, emotions and often their returns.

Challenges Ahead for 2024

2024 challenges are still in the mix and so we maintain our cautious optimism and lean into the stock market’s ability to grow. As we head into the heart of 2024 there are many factors at play. Inflation and interest rate decisions are looming. Employment is continuing to slow down. There is growing pressure on the household economics. As well as geopolitical issues we face abroad and the 2024 election at home. All this leaves too many noisy possibilities to ignore. Despite all that noise, we reaffirm our belief in a positive 2024 for US markets and our investment portfolios. However, we are likely to give some of the early gains back as we move further into 2024 before we find more firm ground in the later portion of the year.

Cheers for a great start to 2024! However, take caution in adjusting expectations any higher based on that beginning.

Resources:

Charts credited to J.P. Morgan’s Guide to the Markets.

More Questions? Contact Us!