ESPPs: A Comprehensive Guide

Executive Summary

Employee Stock Purchase Plans (ESPPs) may be one of the most underutilized, yet valuable employee saving plan benefits. If you are a professional in MedTech with an ESPP available, you should consider participating. This article intends to demystify how ESPPs work and create interest in checking out your own company’s offering.

ESPPs are common among large, publicly traded companies. However, a 2020 survey done by the National Association of Stock Plan Professionals & Deloitte Consulting, found that employees fail to utilize ESPPs when offered. Only 1 in 5 companies report participation above 70%.

What are these plans? Are they worth the trouble? Why should you care? Well, imagine having a employer benefit that allowed you to trade $8,500 of your paychecks for $10,000 — and you could keep doing that every 6 months! Would you have to think about it for very long?

In this article I will discuss:

- How you could be missing out on free money.

- What you need to look out for regarding tax implication and risk.

- Challenges to your personal cash flow.

- How to manage records and avoid tax mistakes.

- How to execute correctly to boost to your financial portfolio.

What is an ESPP?

ESPP stands for Employee Stock Purchase Plan. These plans offer employees the option to purchase company stock at a discount through payroll deductions. Some plans also feature a favorable provision called a lookback as well as other tax benefits. ESPPs are commonly used in large, publicly traded companies that have plenty of liquidity in the stock market to help them run smoothly. However, this is changing with private companies adding ESPPs to their benefits as well. The following information will focus solely on ESPPs at public companies.

Why do companies offer ESPPs in the first place? They were first introduced in the 1970’s to increase employee compensation and encourage ownership of company stock. They provide stock compensation benefits to everyone, not just the top executives. Offering a stock program creates employee loyalty and enables them to feel responsible for improving the company as well as its share price.

However, the typical plan offering has changed since then. Prior to 2005, companies were not required to expense compensation via stock options and ESPPs. This meant they could compensate employees more while having less impact on company earnings. Sadly, the accounting rules have since changed – making the plans less attractive to maintain. Consequently, many companies have scaled back benefits by either shortening offering periods, reducing discounts, or removing lookback features. If your company still offers a 15% discount with a lookback provision you are one of the lucky ones and should take advantage.

How do ESPPs Work?

There are a few terms and definitions to understand. First, employees need to meet eligibility requirements of the plan and join during the plan’s enrollment window.

Next, there are two key time intervals to consider referred to as offering periods and purchase periods. The offering periods can be up to 27 months. They represent the overall period that purchases of company stock will be taking place and have a key impact on purchase prices and taxes.

Within an offering period there are often multiple purchase periods. Purchase periods specify purchase dates within an offering period. For example, your plan could have a 12-month offering period with two 6-month purchasing periods.

After enrollment, you fund the plan through payroll deductions from your paycheck, similar to a 401(k). The contribution limit has a $25,000 maximum based on the share price at the start of a period. It is important to understand this limit is not a simple $25,000 dollar amount like with contributions to your 401(k). We will explore more on this later.

When contributions through your payroll deductions go into the plan, they purchase your company’s stock at a discount. Think about this as a percentage off coupon for your stock purchase. There may also be a lookback provision. This feature allows you to purchase stock at the lower of the offering period date or the purchase date price.

Are ESPPs Worth It?

Our vote is a resounding yes, but let’s take a deeper look. The benefits of ESPPs largely organize into two areas: purchase discounts and tax advantages.

Purchase Discounts

The richest qualified plans offer a lookback feature in addition to a discount off the purchase price. A lookback feature provides additional discount potential because it allows you to purchase at the current market price or the price at the beginning of the offering period, whichever is lower. This means there could be a built-in profit even if the stock price declines during a period or additional return if the price increased.

Examples

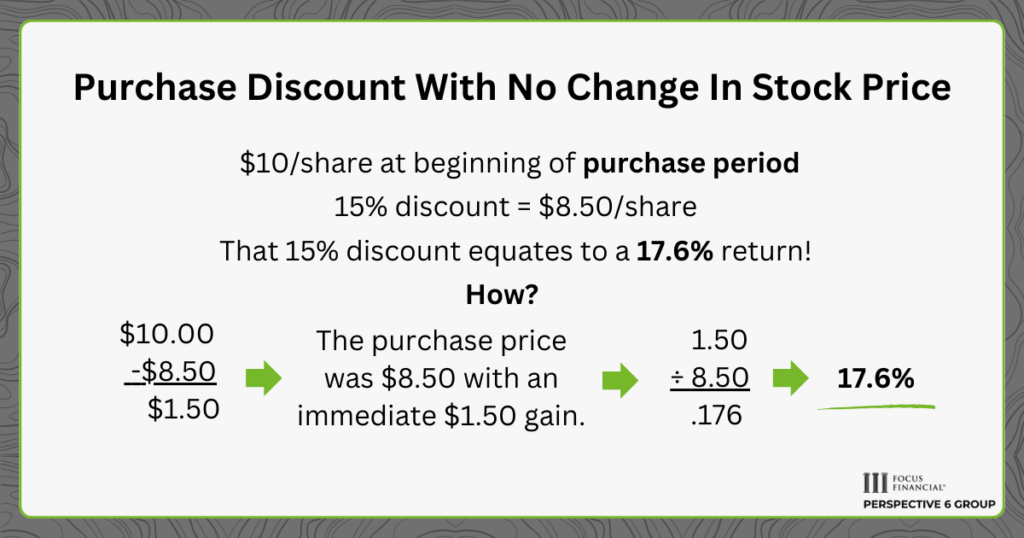

Let’s look at a few examples with both a 15% discount and a lookback feature using a 6-month purchase period.

Stock price remains level with a $10 price at the beginning and ending of the purchase period.

Stock price decreases from $10 to $5 per share at the end of the purchase period.

Stock price increases from $10 to $20 per share over the purchase period.

Now, a caveat to the examples above is not all plans allow an immediate sale of shares. Some plans will impose a blackout period that require holding your stock before selling. For example, there may be a 12-month holding period from purchase date. Having a holding period affects the return potential cited in the above examples and introduces risk that your stock’s price will fall during that time. Always consider this risk if you have more pressing short-term goals for the money.

Tax Benefits of ESPPs

In addition to the discount on stock purchases, there can be favorable tax benefits for ESPPs.

- Unlike other equity compensation such as non-qualified stock options (NSOs) or restricted stock units (RSUs), the taxes on gains from stock purchases in ESPPs defer until the stock is sold.

- Payroll withholding taxes on this income for Social Security & Medicare are avoided. While you will owe Federal and State income taxes on the gains you won’t owe 7.65% for Social Security Income and Medicare.

- Shares held long enough after purchase receive a favorable mix of ordinary income rates and long-term capital gains rates. This is dependent on whether it is a qualifying or disqualifying disposition. I will explain this below.

How do Taxes Work for ESPPs?

The Basics

If you are familiar with other stock option plans, the terms qualifying and disqualifying disposition may sound familiar. If not, don’t let the ominous tone get to you. One is not necessarily better than the other. The important item to understand is that the holding timeframe after acquiring stock in your ESPP determines whether it is a qualifying or disqualifying disposition. Further, the type of disposition determines the amount of ordinary income taxes versus capital gains taxes you’ll pay when selling your stock.

Qualifying vs. Disqualifying Disposition

To have a qualifying disposition, shares must be held for at least one year from the purchase date and two years from the offering date.

- Ordinary income tax is paid on the lesser of:

- The difference between the offering date price and discounted purchase price OR

- The gain between the actual purchase price (with discount) and the final sale price.

- Long-term capital gains are paid on any gain above the discount you receive.

If you don’t hold the shares one year from purchase date and two years from offering date, you’ll have a disqualifying disposition.

- Ordinary income tax will be paid on the difference between the discounted purchase price and market price on day of purchase.

- Capital gains will apply to the difference between the purchase date price and the final sale price. The capital gains will be short-term if stock was held less than one year and long-term if held over one year.

For example, assume your plan’s offering starts on 1/1/2025 and the purchase date is 6/30/2025. A disqualifying disposition would be a sale of stock before 1/1/2027. Selling after 1/2/2027 would be a qualifying disposition.

Once you’ve determined the type of disposition, you can determine the type of taxes owed.

Put simply, in a qualifying disposition more of the tax impact will be long-term capital gains. On the other hand, in a disqualifying disposition, more tax impact will be at income tax rates.

What are the Challenges with Using ESPPs?

Cash Flow

One challenge with participating in your company’s ESSP can simply come down to cash flow. There is only so much to go around. Between 401(k) contributions and all the other deductions for company benefits, it can be difficult to find the cash. It is also important to keep in mind that payroll deferrals to ESPPs are off the top of gross (pre-tax) income and not deductible. Therefore, the effects of saving income out of your paycheck are more noticeable than with a 401(k) deferral.

Plan Contribution Maximum

If cash flow is not a problem, keep in mind there is a $25,000 contribution maximum each year. However, it can be difficult to hit this plan maximum because some plans limit contributions to a percentage of pay, such as 10%. In that situation a $250K+ salary is necessary to even approach the limit.

Even with higher contribution limits and salary, it can be difficult to understand the amount of the cash you defer to purchase shares. The maximum applies to the number of shares that you can purchase and not the purchase date dollar value. The rule is that employees can purchase no more than $25,000 of shares at offering price at the beginning of the period. For example, if the share price was $25/share on the offering date, then you’d be able to purchase 1,000 shares.

However, the number of shares you purchase depends on whether there is a lookback provision in your plan and whether the stock price is increasing or decreasing during the purchase period. For example, consider a falling price during the purchase period from $25 to $20 per share. The purchase price will be $17 with a 15% discount and lookback provision. However, the $25,000 maximum purchase rule limits the purchase to 1,000 shares based on the initial offering price of $25. Therefore, at $17 per share purchase price, the total spent from the cash deferred will only be $17,000. Any excess deferral is typically refunded to you or will roll into the next purchase period. This is where you’ll want to check your plan’s rules and adjust your deferral accordingly.

Common Tax Mistakes Made with ESPPs

It is common to see plan participants making the mistake of not holding their shares long enough. Holding for one year from purchase date will qualify for long-term capital gains rates. Still, to benefit from a qualifying disposition, you must hold for a full two years from the grant date.

Additionally, since having a disqualifying disposition causes you to owe ordinary income taxes, you could owe taxes in a year even if you sell your stock for what you paid. For instance, with a 32% income tax rate and a 15% capital gains rate, the amount of income tax owed on the discount element could be greater than the amount of capital loss you can claim that year. Make a careful evaluation to determine if it is worth waiting out the full two years. Use this calculator to see how: Employee Stock Purchase Plan (ESPP) Calculator – DQYDJ

Tax Documents for Reporting ESPPs

The ordinary income from shares sold will report on W-2’s by the company at the end of each year and companies will provide a Form 3922 specific to ESPP reporting. Employees should get 1099-B from their broker as well to report the proceeds. However, this 1099-B will not likely include the correct information for capital gains and often requires a 1099-Supplemental and brokerage statements to reconcile actual reportable taxable income. Sound confusing? It is. When in doubt rely on a financial advisor or qualified tax professional.

Risks Associated with ESPPs

All stock purchases have risks associated. For instance, if the price falls after purchase, it could mean giving back the entire discount received. As mentioned above, not all plans allow immediate sale. Therefore, check your plan’s rules carefully. Even if it is possible to sell right away, there can be delays depending on plan logistics. For example, there may be lag time for shares to be visible in your brokerage account and before they become available to sell.

You also need to pay attention to the concentration risk of your portfolio. Having too much exposure to your company’s stock creates substantial risk. This can easily happen if you continuously buy shares through your ESPP and hold them long term. Additionally, you need to consider if you are receiving equity compensation from stock options or RSUs as well as purchasing company stock in your 401(k) plan or in personal brokerage account.

There is no hard and fast rule defining concentration risk. However, a guideline we provide our clients with is 10% maximum exposure to a single stock. You may want to consider even smaller levels of exposure since the company also pays your salary and benefits.

Strategies to Use ESPPs Effectively

Determine Goals for ESPP

Consider your “why” for participating in the first place.

- Is it a simple savings goal?

- You can use the convenient payroll deductions and stock purchase discount to build up savings outside your retirement plan.

- Are you trying to build a stock position in your company?

- For example, are you trying to meet holding level requirements as an executive. Using your ESPP can allow you to do this in a tax favorable way. Just be aware of concentration risks previously noted.

- Are you looking for a way to maximize return on your investments?

- Use your stock purchase discount to capture the free return available.

Whatever the goal, ESPPs can be a convenient and discounted savings plan with flexibility. Consider prioritizing your ESPP over other company plans when the need is for short term liquidity vs. long term retirement saving.

Key Strategies for ESPPs

- If your plan’s rules allow for it, sell shares immediately after the purchase date to limit any risk in price change.

- This locks in the discount as an immediate return to then fund savings goals or reinvest elsewhere. Though there are tax advantages to holding your shares longer, keep in mind that disqualifying dispositions are a fine strategy to use if they align with your personal goals.

- Recycle your contributions.

- Once you sell the stock from your initial contributions you can use the proceeds to fund the next period’s purchases. You do this by saving or investing those funds and using them to make up for the income deferred into your ESPP. Continue doing this to increase deferral levels until you are maximizing the plan limits.

ESPP Examples For Comparison

Let’s look at two different examples of ESPPs from well-known companies in the MedTech space as of 2024. Both plans are solid offerings, but how a participant would maximize will be different.

Medtronic

Medtronic’s ESPP allows enrollment each calendar quarter. Contributions need to be from 2-10% of pay. The plan has quarterly purchase periods starting January 1st and offers a 15% discount. There is a $21,250 maximum contribution level, no fractional shares are allowed. Further, there is a blackout period of 1 year before sale or transfer can be completed.

United Health Group

United Health Group’s ESPP opens enrollment 2 times per year and requires contributions to be between 1-10% of pay. There are two purchase periods, from January 2nd-July 1st and July 2nd-January 1st and the discount is 10%. The maximum contribution level is set at 1,000 shares or $25,000 and includes fractional shares. There is no blackout period on selling.

While Medtronic’s ESPP offers a more generous discount than United Health Group’s plan, it does not allow immediate sale. On the flip side, United Health Group’s ESPP has only two purchase periods whereas Medtronic offers four. These plans vary significantly and require different decision-making processes. For instance, Medtronic’s plan may favor holding on for a tax favorable qualifying disposition but with added price risk. Whereas the United Health Group plan may be favorable to immediate sale after purchase to benefit from discount purchase price with very little risk.

In Summary

We covered:

- What is an ESPP?

- How do ESPPs Work?

- Are ESPPs Worth It?

- What are the Challenges of ESPPs?

- Strategies to Use ESPPs Effectively.

Don’t miss out on the significant benefits your company’s ESPP plan offers. Look at all the benefit options available to you and research how they work. Enroll if it aligns with personal goals and financial situation. Most importantly, reach out to a financial advisor. Our team specializes in equity compensation and can guide every step of the way. If you have any questions about your company ESPP reach out and speak with a specialist.

Resources

Will I Have to Pay Tax on My Qualified ESPP?

ESPP: What is an ESPP and how does it work | Fidelity

Employee Stock Purchase Plan – ESPP (+examples & Timeline) (globalshares.com)

ESPP Tax and Return Calculator: Employee Stock Purchase Plan (ESPP) Calculator